Oil

2019, August, 7, 12:25:00

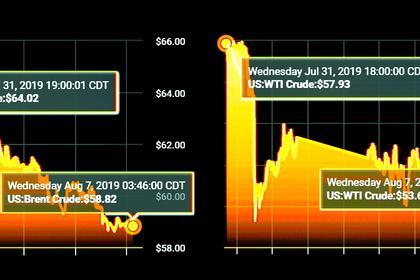

OIL PRICE: BELOW $59

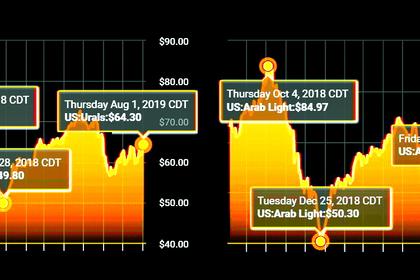

Brent crude futures LCOc1 were down 11 cents, or nearly 2%, at 0823 GMT to set a fresh seven-month low. Prices have lost more than 20% since hitting their 2019 peak in April. U.S. West Texas Intermediate (WTI) crude futures CLc1 were flat at $53.63.

2019, August, 7, 12:20:00

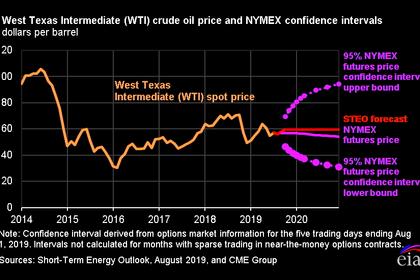

OIL PRICES 2019-20: $64-65

Brent crude oil spot prices averaged $64 per barrel (b) in July, almost unchanged from the average in June 2019 but $10/b lower than the price in July of last year. EIA forecasts Brent spot prices will average $64/b in the second half of 2019 and $65/b in 2020. The forecast of stable crude oil prices is the result of EIA’s expectations of a relatively balanced global oil market. EIA forecasts global oil inventories will increase by 0.1 million barrels per day (b/d) in 2019 and 0.3 million b/d in 2020.

2019, August, 7, 12:15:00

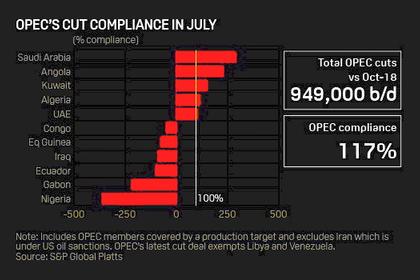

OPEC OIL PRODUCTION 29.88 MBD

OPEC saw output slide to 29.88 million b/d last month, a fall of 210,000 b/d from June, despite output gains by six of its members

2019, August, 7, 12:10:00

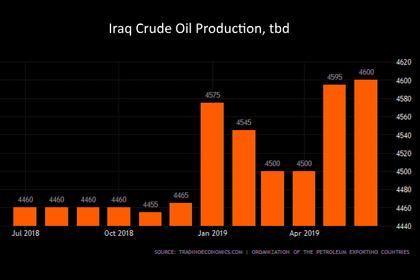

IRAQ'S OIL PRODUCTION 4.62 MBD

Iraq's crude oil production in July rose to 4.62 million b/d, the country's State Oil Marketing Organization said late Sunday, its highest monthly output figure since January 2017, according to official data.

2019, August, 7, 11:50:00

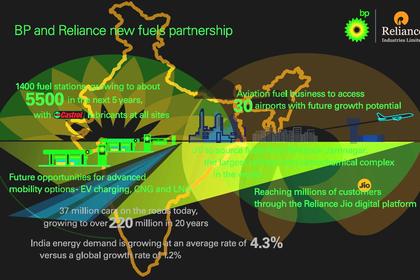

BP, RELIANCE IN INDIA

BP and Reliance Industries Limited (RIL) announced that they have agreed to form a new joint venture that will include a retail service station network and aviation fuels business across India. Building on Reliance's existing Indian fuel retailing network and an aviation fuel business, the partners expect the venture to expand rapidly to help meet the country's fast-growing demand for energy and mobility.

2019, August, 6, 12:45:00

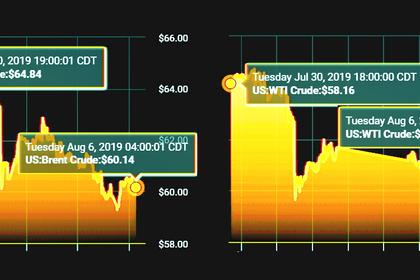

OIL PRICE: NEAR $60

International benchmark Brent futures LCOc1 were up 28 cents at $60.09 a barrel by 0910 GMT, having dipped earlier in the session to their lowest since Jan. 14 at $59.07.

West Texas Intermediate crude CLc1 futures rose 38 cents to $55.07 per barrel.

2019, August, 6, 12:40:00

U.S., UK CAN CLOSE HORMUZ

The UK's Royal Navy will work with the US to assure the security of merchant vessels in the Strait of Hormuz, the Ministry of Defence said.

2019, August, 6, 12:30:00

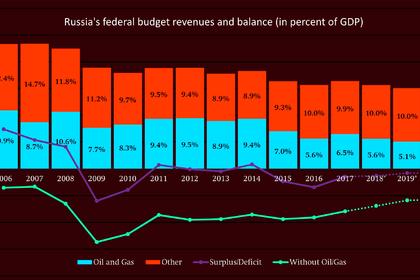

ДОХОДЫ РОССИИ +237 МЛРД.РУБ.

МИНФИН РОССИИ - Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета, связанный с превышением фактически сложившейся цены на нефть над базовым уровнем, прогнозируется в августе 2019 года в размере +237,0 млрд руб.

2019, August, 6, 12:15:00

CHINA WILL TAKE AFRICA'S OIL

China's CNOOC will get a 55.6% stake in the Sinapa and Esperanca licenses from Sweden’s Svenska Petroleum Exploration AB, whose interest will be reduced to 23.03%, FAR said in a statement on Tuesday. It did not disclose financial details.

2019, August, 5, 13:45:00

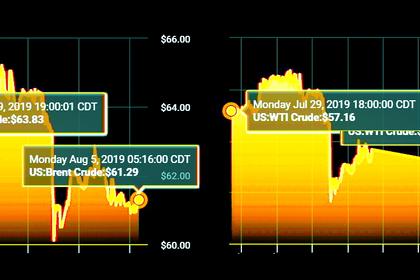

OIL PRICE: NEAR $61

Brent crude futures LCOc1 were down 71 cents, or 1.15%, to $61.18 per barrel by 0840 GMT. U.S. West Texas Intermediate (WTI) crude futures CLc1 were also down 71 cents, or 1.28%, to $54.95 a barrel.

2019, August, 5, 13:40:00

ДИАЛОГ САУДОВСКОЙ АРАВИИ И РОССИИ

Россия высоко ценит сложившийся с Саудовской Аравией диалог и считает необходимым продолжать столь интенсивное взаимодействие, отметил Александр Новак в рамках встречи.

2019, August, 5, 13:35:00

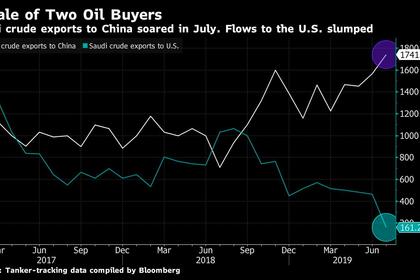

SAUDI ARABIA'S OIL FOR CHINA 1.74 MBD

Saudi Arabia is sending an ever-larger portion of its crude to China - with the US losing out.

2019, August, 5, 13:20:00

CHEVRON'S NET INCOME $4.3 BLN

Exxon Mobil Corporation announced estimated second quarter 2019 earnings of $3.1 billion, or $0.73 per share assuming dilution, compared with $4 billion a year earlier.

2019, August, 5, 13:15:00

EXXON'S NET INCOME $3.13 BLN

Exxon Mobil Corporation announced estimated second quarter 2019 earnings of $3.1 billion, or $0.73 per share assuming dilution, compared with $4 billion a year earlier.

2019, August, 5, 13:10:00

PETROBRAS NET INCOME $1.3 BLN

Accounting net income excluding non-recurring factors was US$ 1.3 billion and operating cash flow reached US$ 5.2 billion. Advances in pre-salt exploration, with lower lifting cost (US$ 6/boe) and better quality of oil, allowed adjusted EBITDA per barrel of oil equivalent (boe) in the exploration & production (E&P) business to reach US$ 33.50 in 2Q19 against US$ 29.50 last year, despite the drop in average Brent oil prices from US$ 71.0 to US$ 68.8.