Oil

2020, January, 13, 14:20:00

U.S. RIGS DOWN 15 TO 781

U.S. Rig Count is down 15 rigs from last week to 781, Canada Rig Count is up 118 rigs from last week to 203

2020, January, 10, 11:55:00

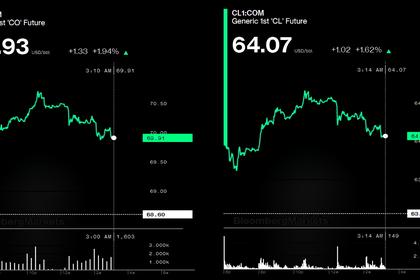

OIL PRICE: ABOVE $65

Brent were up 26 cents, or 0.38%, to $68.53, WTI gained 10 cents, or 0.16%, to $62.80 a barrel.

2020, January, 10, 11:35:00

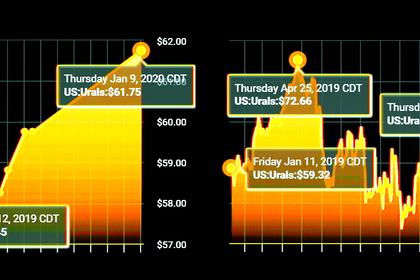

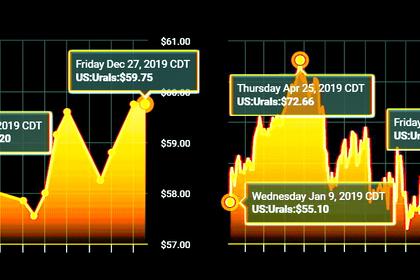

ЦЕНА URALS: $63,59

Средняя цена нефти марки Urals по итогам января – декабря 2019 года составила $ 63,59 за баррель.

2020, January, 10, 11:20:00

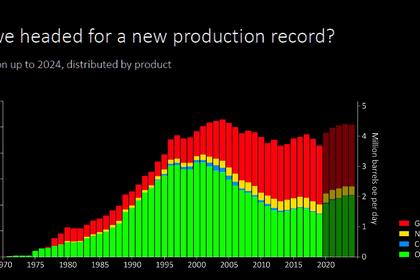

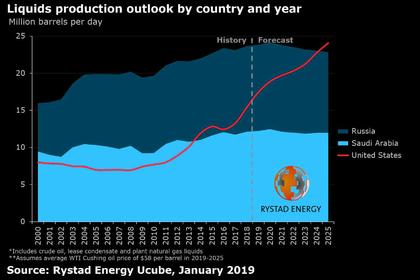

NORWAY'S OIL WILL UP

The Norwegian Petroleum Directorate projects that the overall production of oil and gas in 2024 will be close to the record year 2004 – among other things due to Sverdrup and because the Johan Castberg field in the Barents Sea is scheduled to come on stream in 2022.

2020, January, 10, 11:00:00

WORLDWIDE RIG COUNT UP 1 TO 2,043

The worldwide rig count for December 2019 was 2,043, up 1 from the 2,042 counted in November 2019, and down 201 from the 2,244 counted in December 2018.

2020, January, 8, 14:45:00

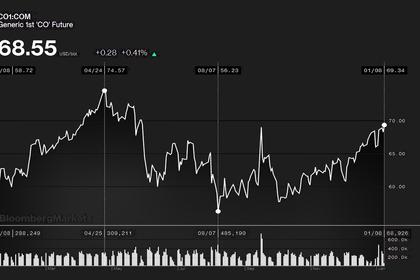

OIL PRICE: NEAR $69

Brent were up 26 cents, or 0.38%, to $68.53, WTI gained 10 cents, or 0.16%, to $62.80 a barrel.

2020, January, 8, 14:25:00

OIL MARKET IS WELL-SUPPLIED

"The market is well-supplied," Suhail Mazrouei said in Abu Dhabi. "I would say now we are not forecasting a shortage of supply unless we have a catastrophic escalation which we don't see."

2020, January, 8, 14:20:00

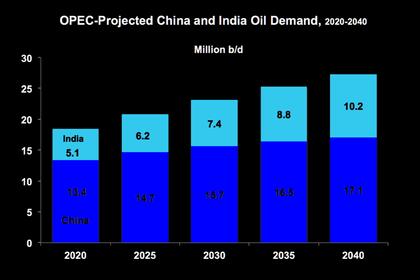

INDIA'S FISCAL PAINS

expects India's oil demand to grow by 170,000 b/d in 2020, up from 155,000 b/in 2019.

2020, January, 8, 14:05:00

ENI'S MIDDLE EAST STRATEGY

The best story, really, is in the Middle East, because we have Abu Dhabi, which became our logistic and technological hub in the region. We have all our people here, and we set up very quickly.

2020, January, 6, 11:25:00

OIL PRICE: NEAR $70

Brent soared to a high of $70.74 a barrel, WTI was at $64.15 a barrel,

2020, January, 6, 11:20:00

РЫНОК НЕФТИ СБАЛАНСИРОВАН

Говоря о ситуации на мировом рынке нефти, Александр Новак отметил, что он достаточно сбалансирован и волатильность на нем низкая.

2020, January, 6, 11:15:00

НЕФТЬ РОССИИ: МИНУС 234 ТБС

В рамках ОПЕК+ Россия по итогам декабря 2019 года вышла на уровень сокращения добычи нефти (без конденсата) в 234 тбс

2020, January, 6, 11:00:00

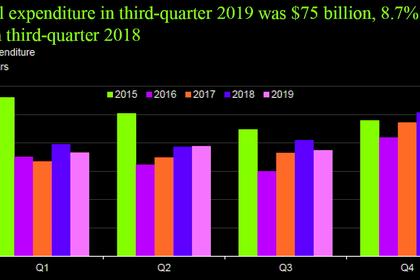

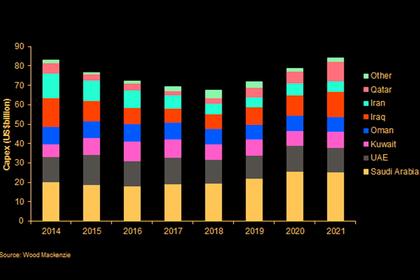

OIL GAS CAPEX DOWN 9%

Capital expenditures were $75 billion in third-quarter 2019, 9% lower than in third-quarter 2018.

2020, January, 6, 10:25:00

OIL & GAS OMAN'S INVESTMENT $30 BLN

Foreign direct investments (FDI) into Oman jumped to $30.26bn (RO11.65bn) in Q2 2019, up 13.3% from the same period in 2018, when it got $26.7bn (RO10.29bn) in FDI, according to the National Centre for Statistics and Information. Investment into manufacturing reached $4.15bn (RO1.6bn) in Q2 2019,

2020, January, 6, 10:15:00

U.S. RIGS DOWN 9 TO 796

U.S. Rig Count is down 9 rigs from last week to 796, Canada Rig Count is down 14 rigs from last week to 85