Oil

2018, November, 7, 11:15:00

ROSNEFT: NET INCOME UP BY 3.4 TIMES

ROSNEFT - 3Q 2018 EBITDA growth by 13.8% QoQ up to RUB 643 bln, 9M 2018 EBITDA growth by 1.6 times YoY up to RUB 1,593 bln with margins improvement

9M 2018 Net Income jumped by 3.4 times YoY up to RUB 451 bln

Free Cash Flow improvement in 3Q 2018 by more than 2 times QoQ up to RUB 509 bln and over 4 times YoY up to RUB 872 bln

2018, November, 7, 11:10:00

ROSNEFT'S PRODUCTION 5.83 MBD

ROSNEFT - Q3 2018 AVERAGE DAILY HYDROCARBON PRODUCTION REACHED 5.83 MMBOE, DEMONSTRATING A 2.1% GROWTH VS. Q2 2018 LEVEL

2018, November, 7, 10:50:00

PETROBRAS NET INCOME $6.6 BLN

PETROBRAS - Net income attributable to the shareholders of Petrobras was US$ 6,622 million in 9M-2018, a 315% increase compared to US$ 1,596 million in 9M-2017. The result improved mainly due to increase in domestic oil products and oil exports margins and to the drop in net finance expenses.

2018, November, 7, 10:45:00

CHEVRON'S NET INCOME $4 BLN

CHEVRON - Chevron Corporation (NYSE: CVX) reported earnings of $4.0 billion ($2.11 per share – diluted) for third quarter 2018, compared with $2.0 billion ($1.03 per share – diluted) in the third quarter of 2017.

2018, November, 7, 10:40:00

VARCO BUYS $500 MLN

NOV VARCO - National Oilwell Varco, Inc. (NYSE: NOV) announced that its Board of Directors has authorized a share repurchase program to purchase up to $500 million of the Company's outstanding common stock.

2018, November, 5, 12:25:00

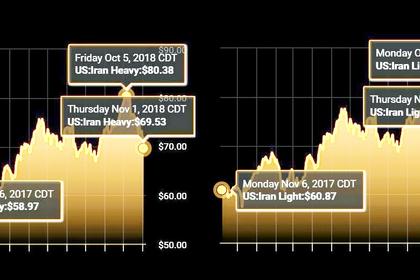

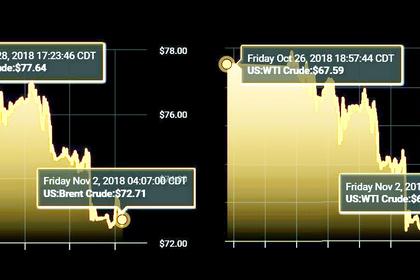

OIL PRICE: NEAR $72

REUTERS - Brent crude oil LCOc1 was down 30 cents a barrel at $72.53 by 0815 GMT. U.S. light crude CLc1 was 30 cents lower at $62.84 a barrel.

2018, November, 5, 12:20:00

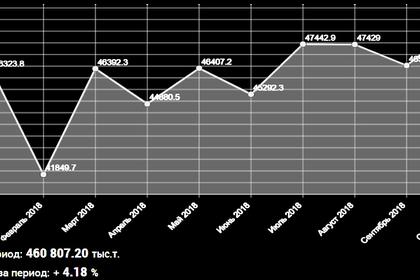

RUSSIA'S OIL PRODUCTION 11.4 MBD

BLOOMBERG - Russia’s crude and condensate output averaged 11.412 million barrels a day last month, according to data from the Energy Ministry’s CDU-TEK unit released Friday. That’s about 160,000 barrels a day more than two years ago, before Russia agreed to cut supply with OPEC. It’s a post-Soviet record, and not far off the highest-ever output.

2018, November, 5, 12:15:00

РОССИЯ: ОБЪЕДИНЕНИЕ ЭНЕРГОСИСТЕМ

МИНЭНЕРГО РОССИИ - На фоне происходящих интеграционных процессов на Евразийском пространстве Электроэнергетический Совет СНГ продолжает играть важную роль в рамках объединения энергосистем государств Содружества.

2018, November, 5, 12:10:00

RUSSIA'S HELP TO IRAN

FT - Russia has vowed to help Iran counter US attempts to throttle its oil sales when sanctions come into effect next week, saying it will continue trading Tehran’s crude in defiance of Washington.

2018, November, 5, 11:50:00

ADNOC'S CAPEX $132 BLN

MEOG - ADNOC plans $132bn Capex until 2023, gas self-sufficiency and oil production capacity of 4mn bpd in 2020

2018, November, 5, 11:45:00

EXXON'S NET INCOME $6.24 BLN

EXXONMOBIL - Exxon Mobil Corporation announced estimated third quarter 2018 earnings of $6.2 billion, or $1.46 per share assuming dilution, compared with $4 billion a year earlier.

2018, November, 2, 12:20:00

OIL PRICE: NOT ABOVE $73

REUTERS - Front-month Brent crude futures were at $72.88 per barrel at 0737 GMT on Friday, 1 cent below their last close. They first fell on Friday on surging supplies, before rising with global markets and then dipping again on the back of the reported Iran sanctions waivers. U.S. West Texas Intermediate (WTI) crude futures were down 33 cents, or 0.5 percent, at $63.36 a barrel.

2018, November, 2, 12:15:00

СОТРУДНИЧЕСТВО РОССИИ И ГЕРМАНИИ

МИНЭНЕРГО РОССИИ - Александр Новак отметил, что энергетическое сотрудничество России и Германии на сегодняшний день развивается сразу в нескольких направлениях – от поставок природного газа и нефти до энергетического машиностроения в России и производства нефтепродуктов на территории Германии.

2018, November, 2, 12:10:00

ЦЕНА URALS: $71.55

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – октября 2018 года составила $ 71,55 за баррель.

2018, November, 2, 12:05:00

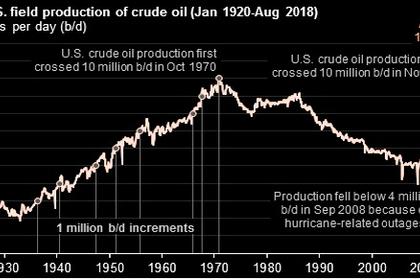

U.S. OIL PRODUCTION 11.3 MBD

U.S. EIA - U.S. crude oil production reached 11.3 million barrels per day (b/d) in August 2018,