Trends

2015, August, 5, 18:15:00

UNDEFINED LNG

US LNG export projects face an uncertain future despite continued discoveries and production growth, a Brookings Institution analyst said. “More liquefaction capacity may be coming than markets can absorb,” warned Tim Boersma, acting director of Brookings’s Energy Security and Climate Initiative.

2015, July, 30, 19:34:00

1Q2015 WORLD OIL & GAS KEY POINTS

Crude oil prices in first-quarter 2015 were the lowest in several years, which contributed to reduced profitability for these companies compared to previous quarters.

Although companies reduced investment spending, declines in operating cash flow were greater, contributing to a decline in cash balances.

Second-quarter 2015 results could show continued declines in profits, cash flow, and capital expenditure.

2015, July, 30, 19:32:00

RUSSIA: THE LARGEST

Russia is the world's largest producer of crude oil (including lease condensate) and the second-largest producer of dry natural gas. Russia also produces significant amounts of coal. Russia's economy is highly dependent on its hydrocarbons, and oil and natural gas revenues account for more than 50% of the federal budget revenues.

2015, July, 30, 19:28:00

GAS: EFFECTIVE WEAPON

Gazprom is first and foremost a tool of Russian foreign policy, which Putin is not shy about wielding to pursue Russian interests. During Putin’s years in power, the Kremlin has used its control over Gazprom — increasing or decreasing the cost of energy — to maintain influence over Russia’s neighbors. Putin once described Gazprom as “a powerful political and economic lever of influence over the rest of the world,” and a team of Russian foreign policy experts noted that “if the leaders of this or that country decide to show good will towards the Russian Federation, then the situation with gas deliveries, pricing policy and former debts changes on a far more favorable note to the buyer.”

2015, July, 13, 19:30:00

US DEBT: THE GREATEST

“It’s a serious problem not just for the United States but for the whole world economy. Debt exceeds gross domestic product there.”

2015, July, 13, 19:20:00

OPEC: LOWER DEMAND

The Organization of the Petroleum Exporting Countries said Monday it revised down the demand for its crude this year, to a level far below its current output, despite higher estimates for global consumption.

2015, July, 13, 19:15:00

OIL CAN DOWN

Massive oversupply is likely to push oil prices down even further, the International Energy Agency (IEA) said on Friday, adding that the rebalancing of the market was likely to last well into 2016.

2015, July, 9, 19:30:00

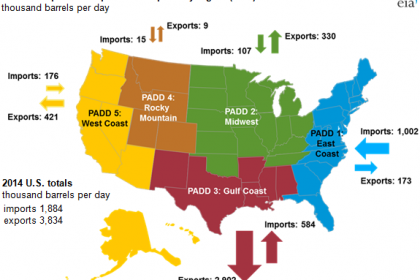

US PETROLEUM UP

Over the past decade, domestic refinery output of petroleum products has grown significantly while consumption has declined, resulting in a major increase in product exports. Petroleum product exports averaged 4.1 million barrels per day (b/d) in the first four months of the year, an increase of 0.5 million b/d over exports the same time last year. Product imports are also higher than last year, but to a lesser extent, leading to an increase in net petroleum product exports.

2015, July, 9, 19:20:00

SHELL NEEDS ARCTIC

Royal Dutch Shell PLC is days away from drilling in the Arctic Ocean—betting it can find enough oil to justify the huge risks that keep almost every other competitor out of those icy waters.

2015, July, 8, 19:25:00

US DEFICIT UP $41.9 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.9 billion in May, up $1.2 billion from $40.7 billion in April, revised.

2015, July, 7, 19:20:00

RUSSIAN GAS KEY

Europe could take advantage of global LNG dynamics, but much of the evolution of the European LNG market depends on Gazprom’s decisions in the short to medium term,

2015, July, 3, 18:45:00

GLOBAL LNG

“Shale was the biggest event to happen in the past decade. As shale gas production increases every year, LNG import levels have dropped drastically in the United States. In 2014, they imported only 1.6 bcm compared to 200 bcm of their total import capacity. Now, it’s expected to become an LNG exporter by the end of this year at the earliest.”

2015, July, 3, 18:40:00

GAS PIPELINE GAMES

Pipelines do not determine flows: infrastructure is necessary, but flows depend on market realities. Nord Stream, for instance, expanded Russia’s export capacity by a third in 2012, yet Russia’s exports are still far below their pre-crisis levels. Exports from Algeria have suffered the same fate: in 2011, Algeria inaugurated a new pipeline to Spain, but Algeria’s pipeline exports to Europe were 35 percent lower in 2014 than in 2010. By contrast, Norway is not building new pipelines but its exports are steady and its market share is growing (since demand, the denominator, is falling).

2015, July, 3, 18:10:00

EUROPE: NO FRACKING

The quest for European energy security this week suffered a pair of setbacks in Britain and Germany, two countries with large reserves of shale oil and gas.

2015, July, 1, 19:30:00

SHALE NEVER DIE

Shale output in the United States will prove resilient to low oil prices likely to be prolonged by the prospect of half a million barrels per day of Iranian crude making its way back to the market.