All publications by tag «»

2018, July, 30, 13:25:00

CHEVRON EARNINGS $3.4 BLN

CHEVRON - Chevron Corporation (NYSE: CVX) reported earnings of $3.4 billion ($1.78 per share – diluted) for second quarter 2018, compared with $1.5 billion ($0.77 per share – diluted) in the second quarter of 2017. Included in the current quarter was a receivable write-down of $270 million charged to operating expense. Foreign currency effects increased earnings in the 2018 second quarter by $265 million, compared with an increase of $3 million a year earlier.

2018, July, 30, 13:20:00

ENI NET PROFIT €1.2 BLN

ENI - Group results

Adjusted operating profit: €2.56 billion, up by 152% on a quarterly basis; €4.94 billion in the first half (up by 73% vs. first half of 2017).

Adjusted net profit: €0.77 billion, up by 66% q-o-q; €1.74 billion, up by 45% in the first half of 2018.

Net profit: €1.25 billion in the second quarter (€2.20 billion in the first half).

2018, July, 30, 13:15:00

WEATHERFORD NET LOSS $264 MLN

WEATHERFORD - Weatherford’s non-GAAP net loss for the second quarter of 2018, which excludes unusual charges and credits, was $156 million,

or $0.16, diluted loss per share. This compares to a $188 million non-GAAP net loss in the prior quarter, or $0.19 diluted loss per share, and a $282 million non-GAAP net loss for the second quarter of 2017, or $0.28 diluted loss per share.

2018, July, 30, 13:10:00

U.S. RIGS UP 2 TO 1,048

BAKER HUGHES A GE - U.S. Rig Count is up 2 rigs from last week to 1,048, with oil up 3 to 861, gas rigs down 1 to 186, and miscellaneous rigs unchanged at 1. Canada Rig Count is up 12 rigs from last week to 223, with oil rigs up 12 to 154 and gas rigs unchanged at 69.

2018, July, 27, 12:53:57

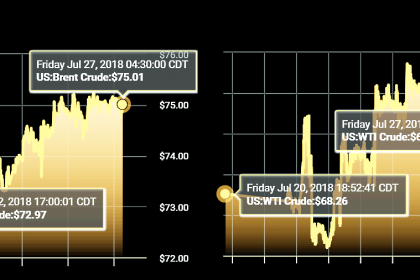

OIL PRICE: ABOVE $74 YET

REUTERS - Brent futures were down 5 cents at $74.49 a barrel by 0319 GMT, after gaining 0.8 percent on Thursday. They are heading for a near 2 percent gain this week, the first weekly increase in four. U.S. West Texas Intermediate futures were 5 cents lower, at $69.56, after rising nearly 0.5 percent in the previous session. The contract is heading for a 1.3 percent weekly loss, a fourth week of declines.

2018, July, 27, 12:50:00

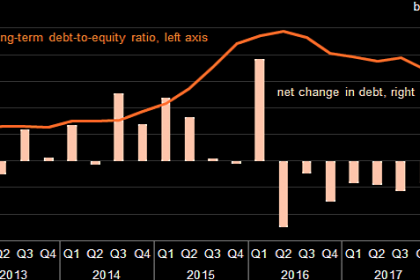

U.S. OIL INVESTMENT UP, DEBT DOWN

EIA - Capital expenditures for these 46 companies totaled almost $19 billion in the first quarter of 2018, a year-over-year increase of nearly $2 billion (10%). Most of these companies have announced that they expect to increase full-year 2018 capital expenditures from 2017 levels.

2018, July, 27, 12:45:00

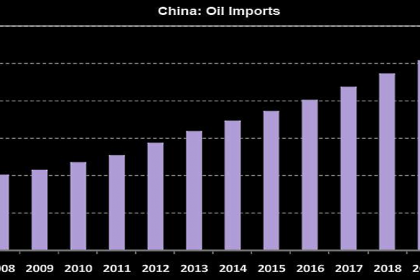

U.S. OIL TO CHINA DOWN

PLATTS - China's crude oil imports from the US for July have fallen sharply from June, and are expected to drop even further for August, vessel tracking data showed, as Beijing's tariffs on US crude imports get closer to implementation.

2018, July, 27, 12:40:00

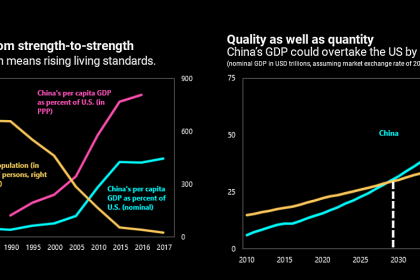

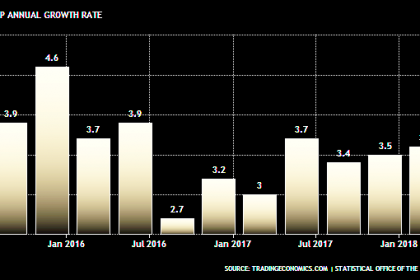

CHINA'S GDP UP TO 6.9%

IMF - The Chinese economy continues to perform strongly. GDP growth accelerated to 6.9 percent in 2017, driven by a cyclical rebound in global trade. Growth is projected to weaken slightly to 6.6 percent in 2018 owing to the lagged effect of financial regulatory tightening and the softening of external demand. Headline inflation has remained contained at around 2 percent and is expected to rise gradually to 2½ percent.

2018, July, 27, 12:35:00

FRANCE'S GDP UP TO 1.8%

IMF - Near-term growth prospects remain favorable, although less buoyant than in 2017. Real GDP growth is projected to reach 1.8 percent this year and 1.7 percent in 2019, supported by robust investment and solid consumption.

2018, July, 27, 12:30:00

SLOVAKIA'S GDP UP TO 3%

IMF - Slovakia’s economic performance continues to be favorable, with real per capita GDP growing at the average annual rate of 3 percent over the past five years. Growth has been supported by predominantly domestic demand. Private consumption continued to benefit from strong credit growth, robust job creation, and rising wages, while investment reversed its temporary decline from 2016 that was due to a slow start in the implementation of new EU funds programming period. Unemployment reached a record low of 7.7 percent at end-2017.