Analysis

2021, February, 24, 10:35:00

US ENERGY SUSTAINABILITY

Severe cold weather in parts of the USA last week contributed to power outages affecting millions of electricity customers across Texas, Louisiana and Oklahoma.

2021, February, 24, 10:25:00

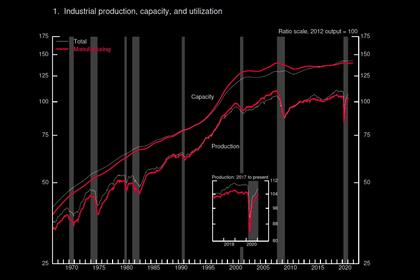

U.S. INDUSTRIAL PRODUCTION UP 0.9%

U.S. industrial production increased 0.9 percent in January.

2021, February, 24, 10:20:00

U.S. RIGS UNCHANGED

U.S. Rig Count is unchanged from last week at 397, Canada Rig Count is down 4 from last week to 172

2021, February, 19, 13:25:00

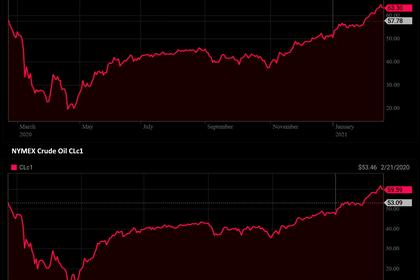

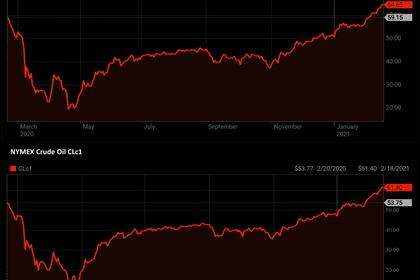

OIL PRICE: NEAR $63

Brent dropped 87 cents, or 1.4%, to $63.06 a barrel. WTI fell 82 cents, or 1.4%, to $59.70 a barrel.

2021, February, 19, 13:10:00

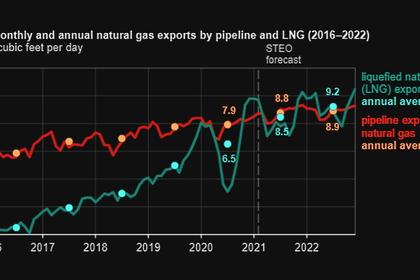

U.S. LNG EXPORTS WILL UP

U.S. liquefied natural gas (LNG) exports will exceed natural gas exports by pipeline in the first and fourth quarters of 2021 and on an annual basis in 2022.

2021, February, 19, 13:05:00

NUCLEAR POWER IS ESSENTIAL

The UK, as host of the next round of UN climate talks, must take the opportunity to show how nuclear energy is essential to decarbonisation,

2021, February, 19, 13:00:00

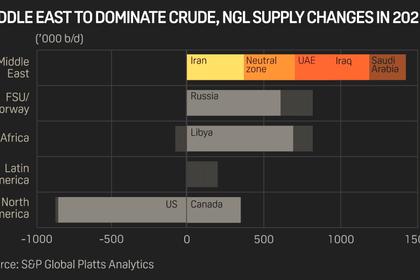

OPEC+ OIL WILL UP

Global liquids supplies are expected to climb by 3.2 million b/d on average in 2021,

2021, February, 19, 12:55:00

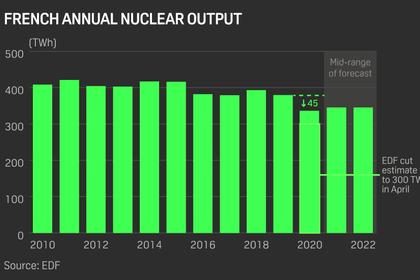

FRANCE'S NUCLEAR TARGET 330-360 TWH

EDF has maintained its 2021 French nuclear output target in a range of 330 TWh-360 TWh after 2020 output fell to a record low of 335.4 TWh, the French utility said Feb. 18.

2021, February, 19, 12:45:00

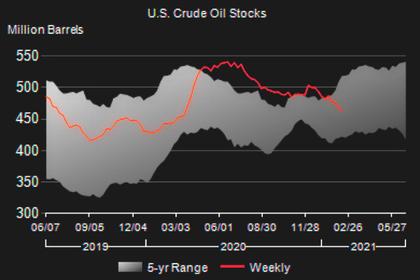

U.S. OIL INVENTORIES DOWN 7.3 MB TO 461.8 MB

U.S. commercial crude oil inventories decreased by 7.3 million barrels to 461.8 million barrels.

2021, February, 18, 12:55:00

OIL PRICE: NEAR $65

Brent was up 56 cents, or 0.9%, at $64.90 a barrel. WTI gained 46 cents, or 0.8%, to $61.60 a barrel.

2021, February, 18, 12:50:00

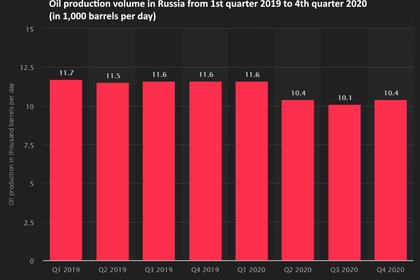

RUSSIA'S OIL PRODUCTION 9.1 MBD

Moscow-based analysts welcomed the latest OPEC+ decision, which allowed Russia to increase output by 65,000 b/d in February, and a further 65,000 b/d in March. Russia's crude output was 9.10 million b/d in December.

2021, February, 18, 12:45:00

ЦЕНА URALS: $57

Средняя цена на нефть Urals за период мониторинга с 15 января 2021 года по 14 февраля 2021 года составила $56,99595 за баррель, или $416,1 за тонну.

2021, February, 18, 12:40:00

JAPAN NEED NUCLEAR POWER

Unfortunately, nuclear energy in Japan currently accounts for just 6% of total power generation, while its share before the Fukushima nuclear accident was as much as 30%.

2021, February, 18, 12:35:00

NUCLEAR HYDROGEN FOR BRITAIN

"Nuclear power should be right at the heart of green hydrogen production, alongside renewable technology.

2021, February, 18, 12:15:00

NOVATEK PROFIT RUB 67.8 BLN

PAO NOVATEK released its audited consolidated financial statements for the year ended 31 December 2020 prepared in accordance with International Financial Reporting Standards (“IFRS”).