Analysis

2021, February, 18, 12:10:00

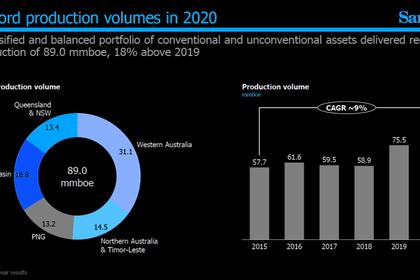

AUSTRALIA'S SANTOS LOSS $357 MLN

The reported net loss after tax of US$357 million includes the previously announced impairments, primarily due to lower oil price assumptions.

2021, February, 17, 16:05:00

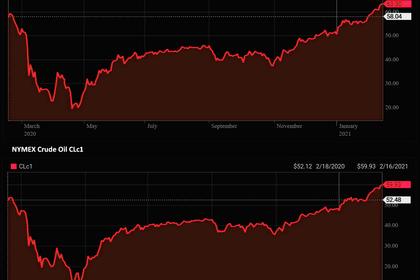

OIL PRICE: ABOVE $63 YET

Brent gained 38 cents, or 0.6%, to $63.73 a barrel. WTI rose 21 cents, or 0.4%, to $60.26 a barrel.

2021, February, 17, 16:00:00

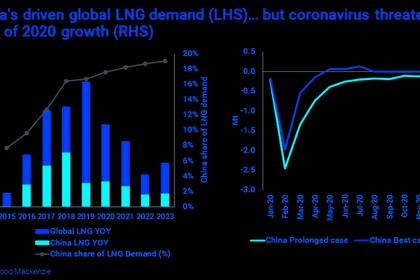

LNG FOR ASIA UP

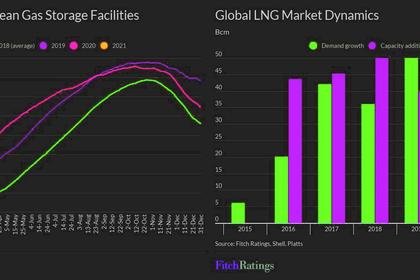

China saw the greatest increase in Asian LNG volumes during 2020, importing 67.4 Mt of LNG, up 11.1% on the 60.7 Mt imported in 2019.

2021, February, 17, 15:55:00

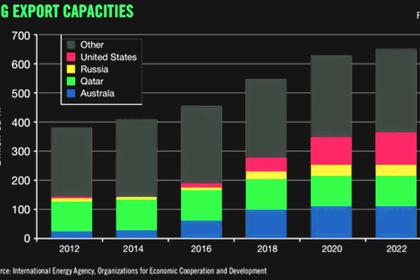

QATAR LNG LEADERSHIP

Qatar will spend billions of dollars expanding its LNG capacity more than 50% to 126 million tons a year.

2021, February, 17, 15:40:00

NORWAY'S OIL, GAS PRODUCTION 2.137 MBD

Preliminary production figures for January 2021 show an average daily production of 2 137 000 barrels of oil, NGL and condensate.

2021, February, 16, 12:20:24

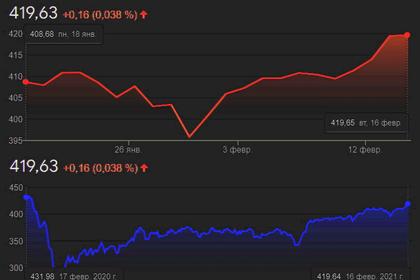

OIL PRICE: ABOVE $63 AGAIN

Brent was up 35 cents, or 0.6%, at $63.65 a barrel. WTI was up 35 cents, or 0.6%, at $63.65 a barrel.

2021, February, 16, 12:15:00

EUROPEAN INDEXES UP ANEW

The pan-European STOXX 600 was up 0.2% by 0802 GMT, after jumping 1.3% in the previous session to its highest level since February 2020.

2021, February, 16, 12:10:00

JAPAN INDEXES UP

The Nikkei 225 Index ended up 1.28% at 30,467.75, closing at its highest since August 1990.

2021, February, 16, 12:05:00

LNG DEMAND UP

Growing liquified natural gas (LNG) demand will reduce market oversupply in 1H21, with volumes of gas in European storage facilities already normalised due to the cold winter in the northern hemisphere,

2021, February, 16, 11:40:00

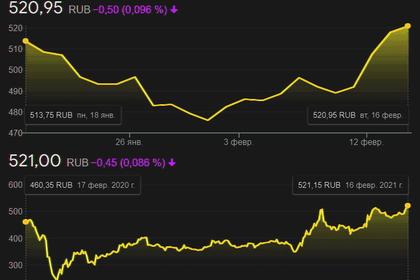

ROSNEFT NET INCOME RUB 147 BLN

Net income in 4Q 2020 reached a record of RUB 324 bln and amounted to RUB 147 bln in 2020.

2021, February, 16, 11:35:00

ROSNEFT PRODUCTION 4 MBD

Brent was up $1.02, or 1.6%, at $63.45 a barrel . WTI gained $1.28, or 2.2%, to $60.75 a barrel.

2021, February, 15, 14:00:00

OIL PRICE: ABOVE $63

Brent was up $1.02, or 1.6%, at $63.45 a barrel . WTI gained $1.28, or 2.2%, to $60.75 a barrel.

2021, February, 15, 13:55:00

GLOBAL INDEXES UP YET

Japan’s Nikkei led the way, climbing 1.9% to reclaim the 30,000-point level for the first time in more than three decades.

2021, February, 15, 13:45:00

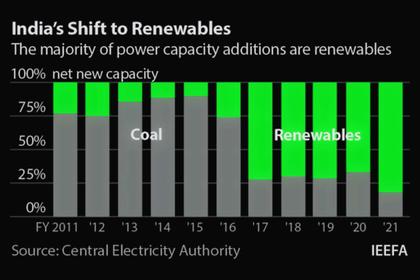

INDIA'S ENERGY TRANSITION RISK $9 BLN

This dramatic growth in renewable energy capacity reinforces the fact that India is witnessing an unprecedented energy transition to low-carbon development,

2021, February, 15, 13:40:00

INDIA'S ENERGY TRANSITION BUDGET 2021-22

Budget 2021-22 is a mixed bag in terms of support for India’s transition to a sustainable, low carbon economy.