Analysis

2020, March, 13, 12:25:00

U.S. ENERGY BONDS: $110 BLN

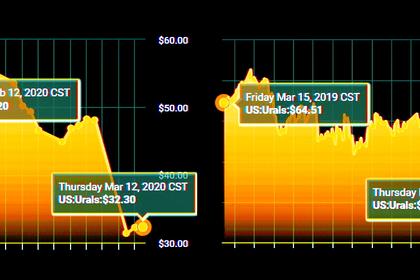

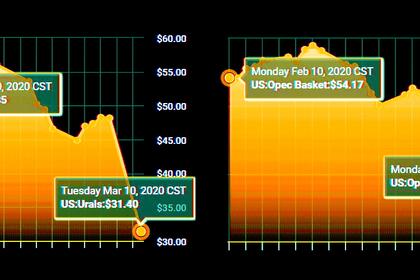

The falls in the bonds come in the wake of the failure of Opec and Russia late last week to agree a deal on cutting production,

2020, March, 13, 12:20:00

RUSSIA FOR U.S. SHALE: $570 BLN

Moscow’s decision to withdraw last week from a pact with Saudi Arabia to limit crude production, sparking an oil war that sent prices crashing 30 per cent on Monday, upending global markets.

2020, March, 13, 12:10:00

ОБЪЕМ ФНБ РОССИИ $123,1 МЛРД.

По состоянию на 1 марта 2020 г. объем ФНБ составил 8 249 592,3 млн. рублей, или 7,3% ВВП, прогнозируемого на 2020 год в соответствии с Федеральным законом от 2 декабря 2019 г. № 380-ФЗ «О федеральном бюджете на 2020 год и на плановый период 2021 и 2022 годов», что эквивалентно 123 145,0 млн. долл. США,

2020, March, 13, 12:05:00

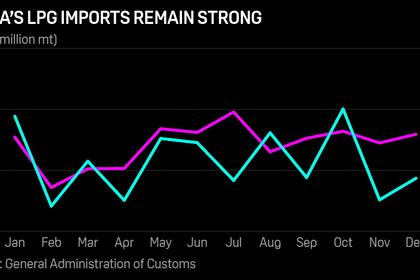

U.S. LPG TO CHINA

The US was the second biggest LPG supplier to China in 2017 at 3.54 million mt, comprising 3.37 million mt of propane and 162,668 mt of butane. The volume dropped 54% a year later in 2018 to 1.62 million mt as a result of trade tensions between the two economies, and in 2019 only 2,443 mt of US propane was imported into China, customs data showed.

2020, March, 13, 12:00:00

GREEN HYDROGEN COST

Researchers have stated that hydrogen is likely to be cost-competitive by 2035. But other technologies, such as battery storage, which have had a head start over hydrogen are more economical in the short term.

2020, March, 12, 13:10:00

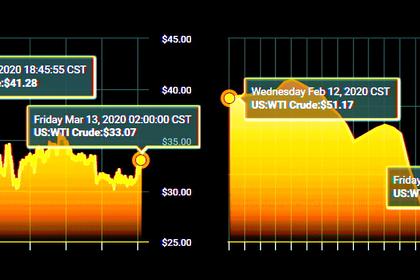

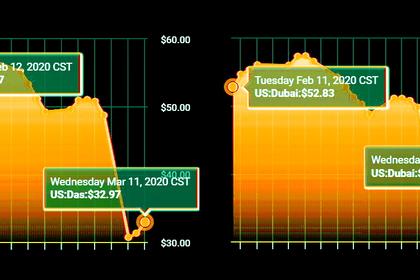

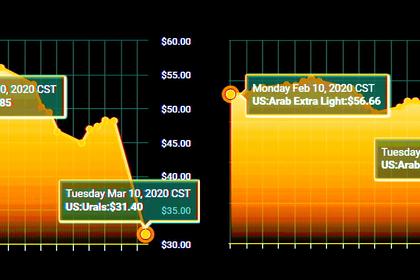

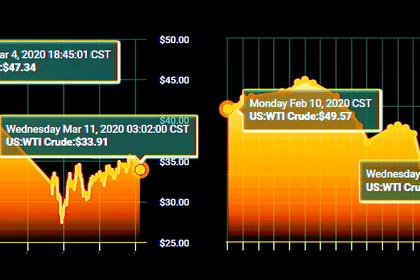

OIL PRICE: NEAR $34

Brent was trading down $1.65, or 4.6%, at $34.14 , WTI was down $1.38, or 4.2%, at $31.60

2020, March, 12, 13:05:00

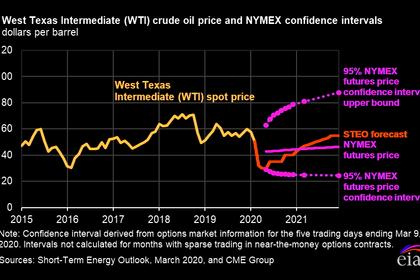

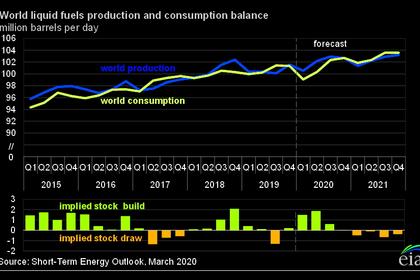

OIL PRICES 2020-21: $43-$55

EIA forecasts Brent crude oil prices will average $43/b in 2020, down from an average of $64/b in 2019. For 2020, EIA expects prices will average $37/b during the second quarter and then rise to $42/b during the second half of the year. EIA forecasts that average Brent prices will rise to an average of $55/b in 2021, as declining global oil inventories put upward pressure on prices.

2020, March, 12, 13:00:00

GLOBAL OIL DEMAND 2020: 99.73 MBD

Total global oil demand is now assumed at 99.73 mb/d in 2020, with 2H20 forecast to see higher consumption than 1H20. Considering the latest developments, downward risks currently outweigh any positive indicators and suggest further likely downward revisions in oil demand growth, should the current status persist.

2020, March, 12, 12:55:00

SAUDI ARABIA, RUSSIA TALKS

Russia has long been seeking to capitalize on its OPEC ties with investment deals, which have been slow to materialize despite official state visits by Saudi King Salman to Moscow in 2017 and Russian President Vladimir Putin to Riyadh in October.

2020, March, 12, 12:40:00

ADNOC CAN SUPPLY 4 MBD

UAE Minister of State and ADNOC Group CEO, Dr. Sultan Ahmed Al Jaber has commented on recent market developments, noting that the UAE oil company is set to supply the market with over four million barrels of oil per day in April 2020.

2020, March, 12, 12:35:00

NORWAY'S FEBRUARY PETROLEUM PRODUCTION 2.1 MBD

Norway's preliminary production figures for February 2020 show an average daily production of 2 106 000 barrels of oil, NGL and condensate,

2020, March, 11, 12:30:00

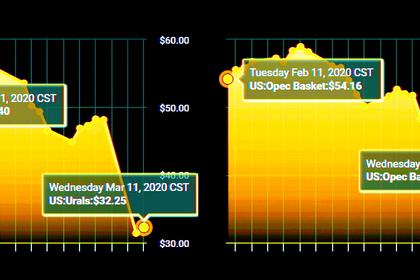

OIL PRICE: NEAR $37 ANEW

Brent slid $0.41, or 1.1%, to $36.81 a barrel, WTI dropped $0.42, or 1.2%, to $33.94 a barrel.

2020, March, 11, 12:25:00

СДЕЛКА ОПЕК + РОССИЯ

В 2019 году была подписана Хартия долгосрочного сотрудничества между государствами ОПЕК и не-ОПЕК.

2020, March, 11, 12:20:00

SAUDI ARABIA, RUSSIA'S OIL UP

The clash of oil titans Saudi Arabia and Russia sparked a 25% slump in crude prices on Monday, triggering panic selling on Wall Street and other equity markets that have already been badly hit by the impact of the coronavirus outbreak.

2020, March, 11, 12:15:00

U.S. OIL DOWN

U.S. shale companies need prices at least in the low $40s to cover costs,