Analysis

2018, September, 17, 14:45:00

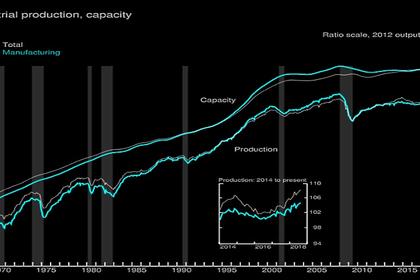

U.S. INDUSTRIAL PRODUCTION UP 0.4%

U.S. FRB - Industrial production rose 0.4 percent in August for its third consecutive monthly increase. Manufacturing output moved up 0.2 percent on the strength of a 4.0 percent rise for motor vehicles and parts; motor vehicle assemblies jumped to an annual rate of 11.5 million units, the strongest reading since April. Excluding the gain in motor vehicles and parts, factory output was unchanged.

2018, September, 17, 14:40:00

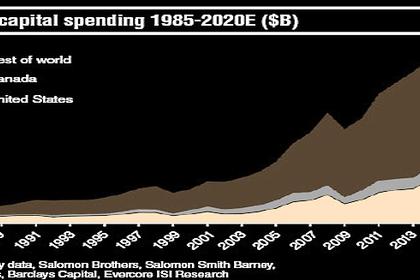

U.S. RIGS UP 7 TO 1,055

BAKER HUGHES A GE - U.S. Rig Count is up 7 rigs from last week to 1,055, with oil rigs up 7 to 867, gas rigs unchanged at 186, and miscellaneous rigs unchanged at 2. Canada Rig Count is up 22 rigs from last week to 226, with oil rigs up 15 to 148 and gas rigs up 7 to 78.

2018, September, 14, 12:45:00

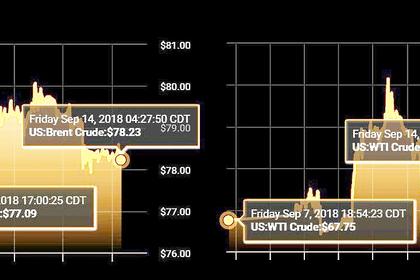

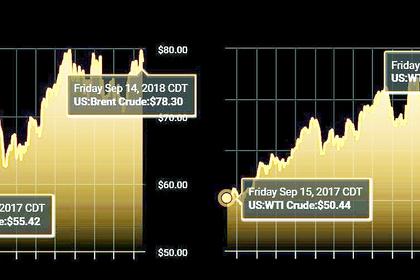

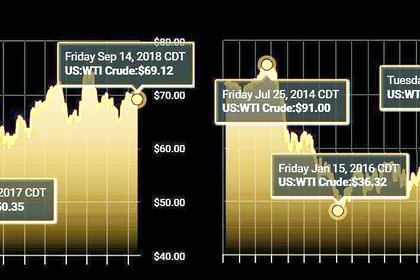

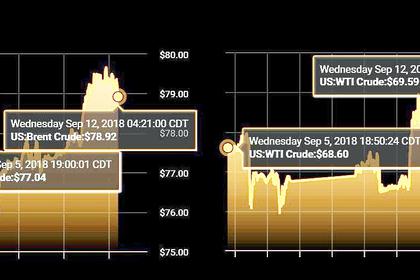

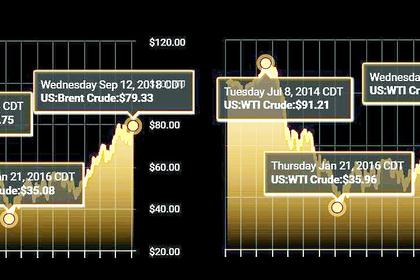

OIL PRICE: NOT ABOVE $79

REUTERS - Brent crude was up 3 cents at $78.21 a barrel by 0634 GMT, after falling 2 percent on Thursday. The global benchmark rose on Wednesday to its highest since May 22 at $80.13. U.S. West Texas Intermediate (WTI) futures were up 18 cents, or 0.2 percent, at 68.76 a barrel, after dropping 2.5 percent on Thursday.

2018, September, 14, 12:40:00

IEA: OIL PRICES COULD RISE

IEA - If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise without offsetting production increases from elsewhere.

2018, September, 14, 12:30:00

FIXED U.S. OIL PRICE

REUTERS - U.S. shale producers are locking in prices for their production as much as three years into the future in a sign that strong domestic crude pricing is nearing a peak, according to market sources familiar with money flows.

2018, September, 14, 12:25:00

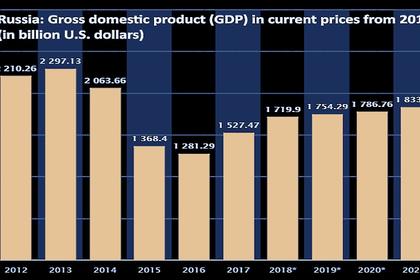

IMF: RUSSIA IS BETTER

IMF - Russia’s economy is recovering from the 2015–16 recession, thanks to the authorities’ effective policy response and higher oil prices. Output increased by 1.5 percent in 2017 on the back of robust domestic demand, but short of expectations. Inflation has fallen well below the CBR's 4 percent target since July 2017, driven by a weaker-than-expected recovery, tight monetary policy, as well as temporary effects on food and energy prices.

2018, September, 13, 14:35:00

OIL PRICE: NEAR $79 YET

REUTERS - Benchmark Brent crude oil LCOc1 was down 70 cents a barrel at $79.04 by 0830 GMT. U.S. light crude CLc1 fell $1.15 to a low of $69.22 a barrel.

2018, September, 13, 14:15:00

АЗИЯ - МИРОВОЙ ДРАЙВЕР

МИНЭНЕРГО РОССИИ - «Азиатско-Тихоокеанский регион – мировой драйвер по развитию экономики, по потреблению энергоресурсов и торговли», - подчеркнул Александр Новак.

2018, September, 13, 14:10:00

U.S. SANCTIONS AGAINST THE WORLD

CNBC - "We can see that the pricing situation today depends not just on the supply/demand balance or the general economic situation but also on the uncertainty that we observe today in the global markets: the trade wars, the sanctions that the U.S. pursue," Novak said, speaking to CNBC's Geoff Cutmore at the Eastern Economic Forum (EEF) in Vladivostok, Russia.

2018, September, 13, 14:00:00

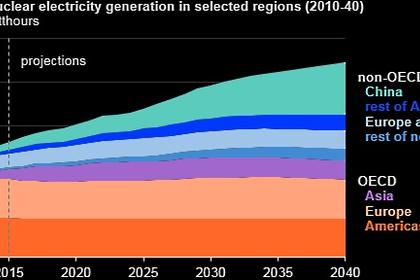

NUCLEAR POWER NEEDS INVESTMENT

IAEA - Overall, the new projections suggest that nuclear power may struggle to maintain its current place in the world’s energy mix. In the low case to 2030, the projections show nuclear electricity generating capacity falling by more than 10% from a net installed capacity of 392 gigawatts (electrical) (GW(e)) at the end of 2017. In the high case, generating capacity increases 30% to 511 GW(e), a drop of 45 GW(e) from last year’s projection. Longer term, generating capacity declines to 2040 in the low case before rebounding to 2030 levels by mid-century, when nuclear is seen providing 2.8% of global generating capacity compared with 5.7% today.

2018, September, 12, 12:30:00

OIL PRICE: NEAR $79

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $69.93 per barrel at 0646 GMT, up 68 cents, or 1 percent, from their last settlement. WTI futures gained 2.5 percent in the previous session. Brent crude futures LCOc1 climbed 30 cents, or 0.4 percent, to $79.36 a barrel. Brent has climbed for four straight sessions, gaining 2.2 percent the previous day.

2018, September, 12, 11:50:00

OPEC CAN INCREASE

PLATTS - "There is a fairly significant combined potential by the countries [participating in the deal] that can increase production and this potential can be used if necessary," Novak said Wednesday.

2018, September, 12, 11:45:00

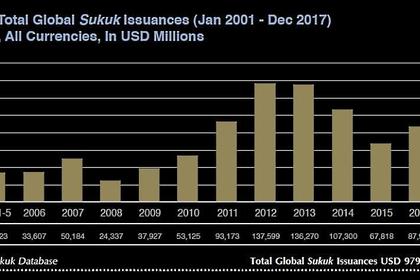

SAUDIS BONDS: $2 BLN

REUTERS - Saudi Arabia has started marketing U.S. dollar-denominated sukuk, or Islamic bonds, with the issue expected to be around $2 billion in size, a document showed on Wednesday.

2018, September, 12, 11:35:00

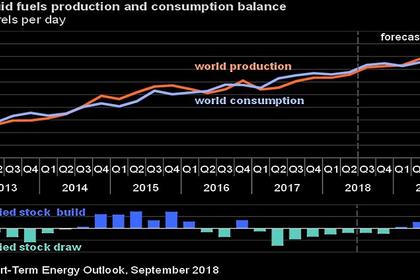

OIL PRICES 2018-19: $73-$74

U.S. EIA - EIA expects Brent spot prices will average $73/b in 2018 and $74/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for December 2018 delivery that traded during the five-day period ending September 6, 2018, suggest a range of $56/b to $85/b encompasses the market expectation for December WTI prices at the 95% confidence level.

2018, September, 12, 11:30:00

WORLDWIDE RIG COUNT UP 27 TO 2,278

BAKER HUGHES A GE - The worldwide rig count for August 2018 was 2,278, up 27 from the 2,251 counted in July 2018, and up 162 from the 2,116 counted in August 2017.