Analysis

2018, March, 16, 10:15:00

U.S. PETROLEUM DEMAND: 20.3 MBD

API - Led by gasoline and seasonal demand for heating fuels, U.S. petroleum demand hit 20.3 million barrels per day (MBD) in February. Demand was up by more than a million barrels per day from February of last year, nearing record highs not seen for more than a decade.

2018, March, 14, 11:45:00

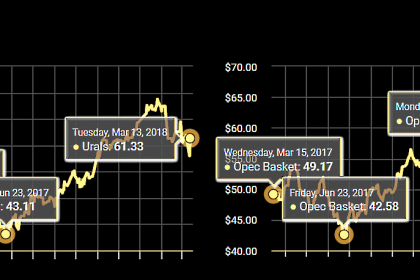

OIL PRICE: NOT ABOVE $65

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement.

Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

2018, March, 14, 11:20:00

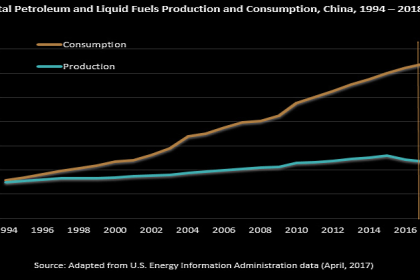

CHINA'S OIL PRODUCTION DOWN

REUTERS - The country churned out 30.37 million tonnes of crude in the first two months of the year, according to data from he National Bureau of Statistics, equivalent to 3.76 million barrels per day (bpd) and on a par with the weakest level in data stretching back to June, 2011.

2018, March, 14, 11:15:00

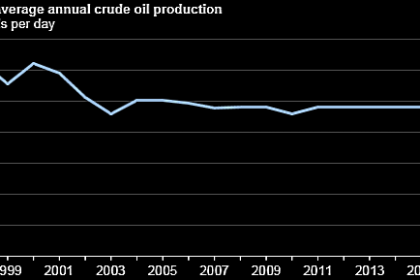

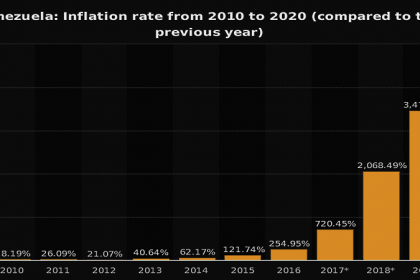

VENEZUELA'S OIL PRODUCTION DOWN

EIA - Venezuela’s crude oil production has been on a downward trend for two decades, but it has experienced significant decreases over the past two years. Crude oil production in Venezuela decreased from 2.3 million barrels per day (b/d) in January 2016 to 1.6 million b/d in January 2018. A combination of relatively low global crude oil prices and the mismanagement of Venezuela’s oil industry has led to these accelerated declines in production.

2018, March, 14, 11:00:00

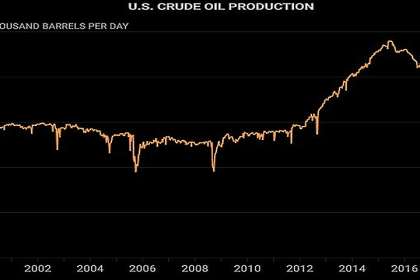

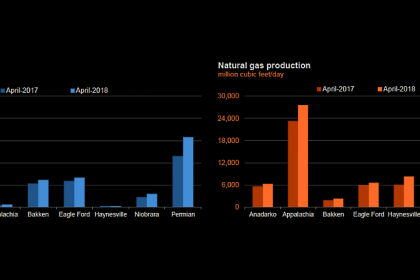

U.S. OIL + 131 TBD, GAS + 969 MCFD

EIA - Crude oil production from the major US onshore regions is forecast to increase 131,000 b/d month-over-month in April from 6,823 to 6,954 thousand barrels/day , gas production to increase 969 million cubic feet/day from 65,150 to 66,119 million cubic feet/day .

2018, March, 12, 08:50:00

OIL PRICE: NOT ABOVE $66

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $62.10 a barrel at 0407 GMT, up 6 cents, or 0.1 percent.

Brent crude futures LCOc1 were at $65.58 per barrel, up 9 cents, or 0.1 percent, from their previous close.

2018, March, 12, 08:30:00

VENEZUELA'S RATINGS DOWN

MOODY'S - Moody's Investors Service has downgraded the Government of Venezuela's foreign currency and local currency issuer ratings, foreign and local currency senior unsecured ratings, and foreign currency senior secured rating to C from Caa3. Concurrently, the foreign currency senior unsecured medium term note program has also been downgraded to (P)C from (P)Caa3. The outlook has been changed to stable from negative.

2018, March, 11, 11:40:00

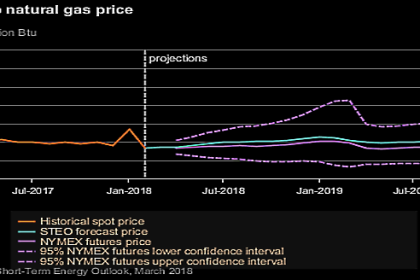

GAS PRICES: ABOUT $2.732

PLATTS - The NYMEX April natural gas futures contract settled at $2.732/MMBtu Friday, shedding 2.4 cents day on day and notching its second decline in a row.

2018, March, 11, 11:35:00

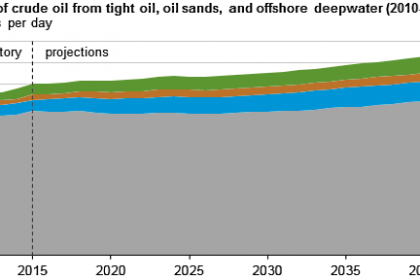

GLOBAL TIGHT OIL INVESTMENT

EIA - Brent global benchmark crude oil price will increase throughout the projection period but will remain lower than prices during 2010–2014 in real dollar terms. For this reason, future investment growth in higher-cost resources is expected to be lower than in recent history. Global production of tight oil will increase by 3.3 million b/d, offshore deepwater by 2.7 million b/d, and oil sands by 1.4 million b/d between 2017 and 2040. Total production increases from these sources makes up nearly half of the long-term global liquids supply growth through 2040.

2018, March, 11, 11:30:00

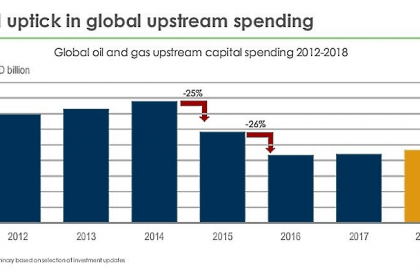

U.S. OIL INVESTMENT

REUTERS - “The stability in oil prices is a net positive. If energy companies can demonstrate to investors that they can generate cash flow in the current oil price environment, they can go public,” said Grant Kernaghan, Citigroup’s managing director of Canadian investment banking. “The recent volatility hasn’t resulted in markets shutting down,” he added, suggesting equity markets were still open despite a 10-session period up to Feb. 8 when the S&P 500 dropped over 10 percent.

2018, March, 11, 11:20:00

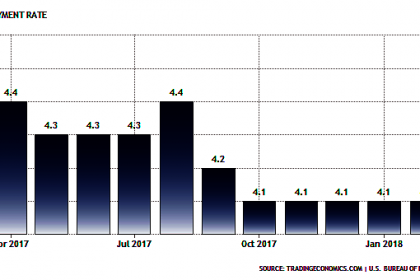

U.S. UNEMPLOYMENT RATE 4.1%

U.S. BLS - Total nonfarm payroll employment increased by 313,000 in February, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment rose in construction, retail trade, professional and business services, manufacturing, financial activities, and mining.

2018, March, 11, 11:00:00

U.S. RIGS UP 3 TO 984

BAKER HUGHES A GE - U.S. Rig Count is up 3 rigs from last week to 984, with oil rigs down 4 to 796, gas rigs up 7 to 188.

Canada Rig Count is down 29 rigs from last week to 273, with oil rigs down 15 to 196 and gas rigs down 14 to 77.

2018, March, 9, 13:45:00

OIL PRICE: NOT ABOVE $64

REUTERS - Brent crude futures LCOc1 were at $63.79 per barrel at 0753 GMT, up 18 cents, or 0.3 percent, from their previous close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.24 a barrel, up 12 cents, or 0.2 percent.

2018, March, 9, 13:40:00

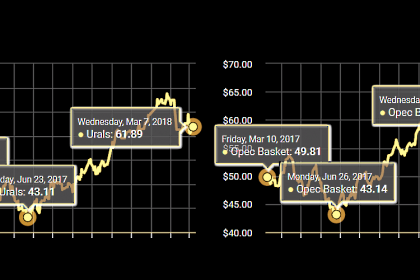

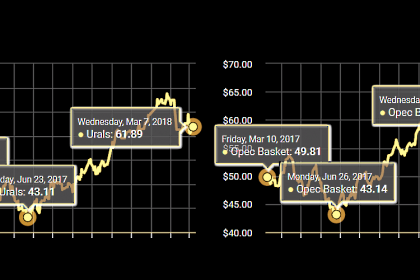

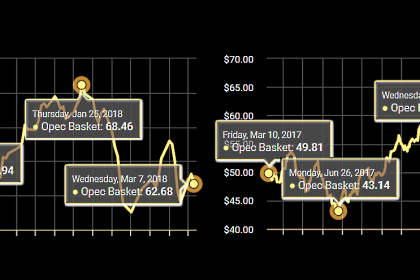

OPEC OIL PRICE: $66.85

OPEC - The OPEC Reference Basket increased for the fifth-straight month in January, gaining a sharp 7.7% to average $66.85/b, the highest monthly average since November 2014. Oil prices were supported by continuing efforts by OPEC and participating non-OPEC producers to balance the market and ten consecutive weeks of crude inventory draws amid healthy economic growth and improving oil demand.

2018, March, 9, 13:35:00

U.S. OIL EXPORTS - 2017: 1.1 MBD

EIA - Exports grew to 1.1 million barrels per day (b/d) in 2017, or 527,000 b/d (89%) more than exports in 2016, in the second full year of unrestricted U.S. crude oil exports. This is the largest single year-over-year increase of a petroleum (crude oil and petroleum products) export since 1920.