Finance

2019, February, 8, 11:05:00

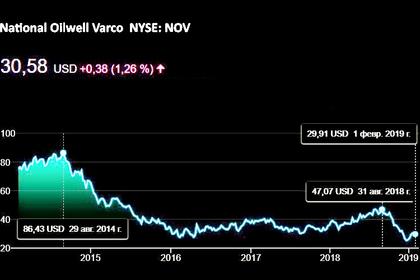

NOV VARCO NET LOSS $31 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported fourth quarter 2018 revenues of $2.40 billion, an increase of 11 percent compared to the third quarter of 2018 and an increase of 22 percent from the fourth quarter of 2017. Operating profit for the fourth quarter of 2018 was $87 million, or 3.6 percent of sales, Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) was $279 million, or 11.6 percent of sales, and net income was $12 million. Operating profit increased 19 percent sequentially, and Adjusted EBITDA increased 14 percent sequentially and 42 percent compared to the fourth quarter of 2017. Other items totaled $21 million, pre-tax, and were primarily related to charges associated with the closure of one of the Company’s facilities.

2019, February, 6, 11:05:00

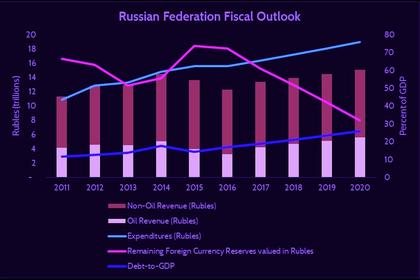

ДОХОДЫ РОССИИ +203,6 МЛРД.РУБ.

МИНФИН РОССИИ - Ожидаемый объем дополнительных нефтегазовых доходов федерального бюджета, связанный с превышением фактически сложившейся цены на нефть над базовым уровнем, прогнозируется в феврале 2019 года в размере +203,6 млрд руб.

2019, February, 6, 11:00:00

ROSNEFT'S NET INCOME, $: +134%

ROSNEFT - Financial results for 12M 2018 and 4Q 2018

EBITDA growth by 1.5 times YoY up to RUB 2 trln with margins improvement up to 25%

Net Income jumped by 2.5 times YoY up to RUB 549 bln in 12M 2018

Fee cash flow in 12M 2018 up to USD 17.9 bln

Drop over USD 14 bln of total trading prepayments and net debt

2019, February, 6, 10:35:00

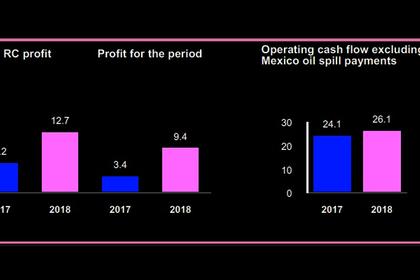

BP PROFIT $9.4 BLN

BP - Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. The fourth quarter result was $3.5 billion, driven by the strong operating performance across all business segments.

2019, February, 6, 10:25:00

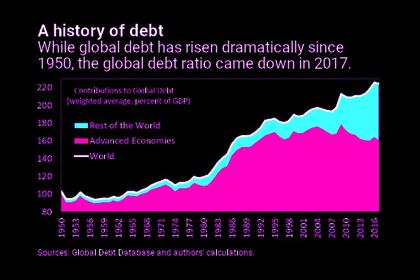

IMF: GLOBAL DEBT

IMF - Global debt has reached an all-time high of $184 trillion in nominal terms, the equivalent of 225 percent of GDP in 2017. On average, the world’s debt now exceeds $86,000 in per capita terms, which is more than 2½ times the average income per-capita.

2019, February, 4, 10:00:00

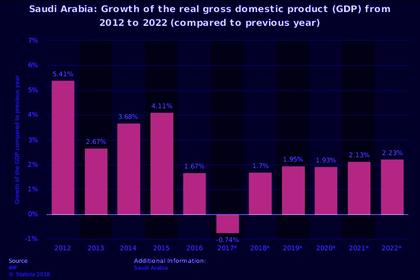

SAUDI ARABIA ECONOMY UP 2.2%

REUTERS - Saudi Arabia’s economy grew at a pace of 2.21 percent in 2018, buoyed by strong oil sector growth and recovering from a contraction in 2017 when the economy was hurt by weak oil prices and austerity measures, government data showed on Thursday.

2019, February, 4, 09:50:00

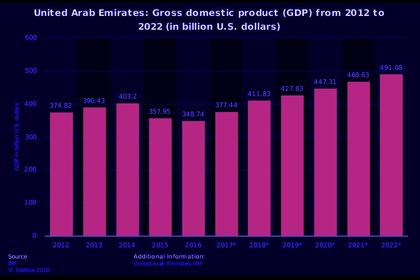

UAE GDP UP 3.7%

IMF - The economy is starting to recover from the 2015–16 slowdown caused by a decline in oil prices. Growth momentum is expected to strengthen in the next few years with increased investment and private sector credit, improved prospects in trading partners, and a boost to tourism from Expo 2020. Non-oil growth is projected to rise to 3.9 percent in 2019 and 4.2 percent in 2020. The oil sector’s prospects have also improved with higher oil prices and output. Overall real GDP growth is projected at around 3.7 percent for 2019–20.

2019, February, 4, 09:40:00

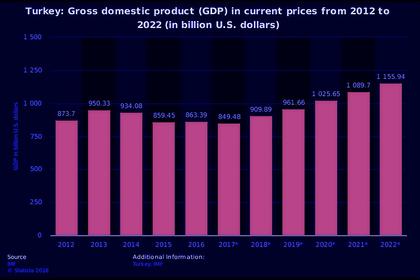

TURKEY: NO IMF

GULF TIMES - Turkey’s top economic body ruled out seeking support from the International Monetary Fund, in an effort to end market speculation that Ankara is in touch with the Washington-based lender to negotiate a rescue package.

2019, February, 4, 09:35:00

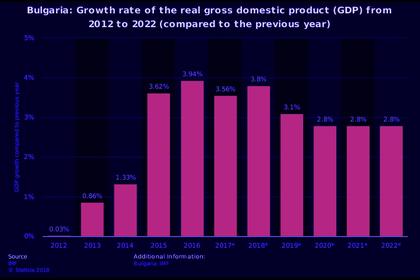

BULGARIA'S GDP UP 3.3%

IMF - Output is estimated to have grown by 3.2 percent in 2018, unemployment to have fallen to close to 5 percent, and the current account to have recorded another sizable surplus. Prospects for 2019 are for more of the same––we are projecting real GDP growth of 3.3 percent. However, the downside risks to this outlook have recently risen, owing to a sharper-than-anticipated slowdown in global trade and unsettled financial markets.

2019, February, 4, 09:30:00

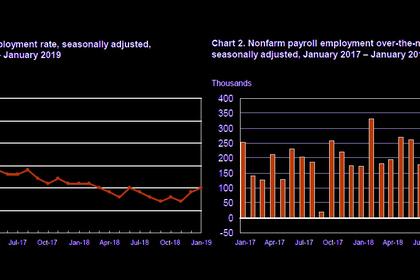

U.S. UNEMPLOYMENT UP TO 4%

U.S. BLS - Total nonfarm payroll employment increased by 304,000 in January, and the unemployment rate edged up to 4.0 percent, the U.S. Bureau of Labor Statistics

reported. Job gains occurred in several industries, including leisure and hospitality, construction, health care, and transportation and warehousing.

2019, February, 4, 09:20:00

EXXON NET INCOME $20.8 BLN

EXXONMOBIL - Exxon Mobil Corporation announced estimated 2018 earnings of $20.8 billion, or $4.88 per share assuming dilution, compared with $19.7 billion a year earlier. Excluding U.S. tax reform and asset impairments, earnings were $21 billion, compared with $15.3 billion in 2017. Cash flow from operations and asset sales was $40.1 billion, including proceeds associated with asset sales of $4.1 billion. Capital and exploration expenditures were $25.9 billion, including incremental spend to accelerate value capture.

2019, February, 1, 10:55:00

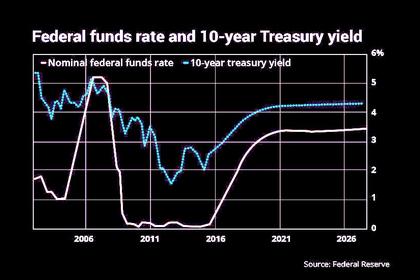

U.S. FEDERAL FUNDS RATE 2.25-2.5%

U.S. FRB - Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.

2019, February, 1, 10:45:00

SHELL EARNINGS $21.4 BLN UP 36%

SHELL - Compared with the fourth quarter 2017, CCS earnings attributable to shareholders excluding identified items of $5.7 billion mainly benefited from higher realised oil, gas and LNG prices as well as stronger contributions from crude oil and LNG trading, partly offset by movements in deferred tax positions. Full year earnings of $21.4 billion also reflected higher realised oil, gas and LNG prices, partly offset by movements in deferred tax positions.

2019, February, 1, 10:40:00

SHELL THIRD BUYBACK

SHELL - Royal Dutch Shell plc (the ‘company’) announces the commencement of trading in the third tranche of its share buyback programme previously announced on July 26, 2018. In the third tranche, the company has entered into an irrevocable, non-discretionary arrangement with a broker to enable the purchase of A ordinary shares and/or B ordinary shares for a period up to and including April 29, 2019.

2019, February, 1, 10:35:00

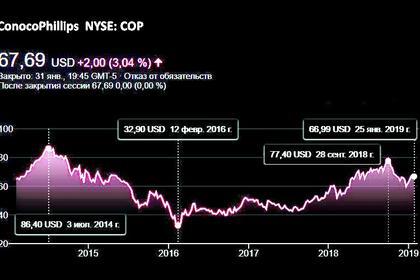

CONOCO EARNINGS $5.3 BLN

CONOCOPHILLIPS - Full-year 2018 earnings were $6.3 billion, or $5.32 per share, compared with a full-year 2017 net loss of $0.9 billion, or ($0.70) per share. Excluding special items, full-year 2018 adjusted earnings were $5.3 billion, or $4.54 per share, compared with full-year 2017 adjusted earnings of $0.7 billion, or $0.60 per share.