Oil&Gas

2017, September, 15, 08:50:00

NIGERIA NEEDS TIME

Emmanuel Kachikwu, Nigeria’s minister of state for petroleum resources, told the Financial Times that the west African nation’s energy sector was still suffering from years of violent disruptions and needed more “recovery time” before joining a supply deal agreed last year between some of the world’s biggest oil producers.

2017, August, 28, 19:45:00

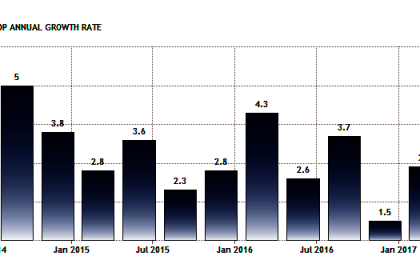

IMF: BAHRAIN'S VULNERABILITY UP

Bahrain’s fiscal and external vulnerabilities have increased in the wake of the oil price decline. Overall GDP grew 3 percent in 2016, supported by strong growth of 3.7 percent in the non-oil sector aided by the implementation of GCC-funded projects. Average inflation remained moderate at 2.8 percent. Bank deposit and private sector credit growth slowed. The banking sector remains well capitalized and liquid. Despite the implementation of significant fiscal adjustment, lower oil prices meant that the overall fiscal deficit reached nearly 18 percent of GDP and government debt rose to 82 percent of GDP. The current account deficit widened to 4.7 percent. International reserves have declined.

2017, August, 3, 12:05:00

BP PROFIT $553 MLN

“We continue to position BP for the new oil price environment, with a continued tight focus on costs, efficiency and discipline in capital spending. We delivered strong operational performance in the first half of 2017 and have considerable strategic momentum coming into the rest of the year and 2018, with rising production from our new Upstream projects and marketing growth in the Downstream.”

2017, July, 31, 14:00:00

U.S. RIGS UP 8 TO 958

U.S. Rig Count is up 495 rigs from last year's count of 463, with oil rigs up 392, gas rigs up 106, and miscellaneous rigs down 3 to 0.

Canadian Rig Count is up 101 rigs from last year's count of 119, with oil rigs up 69, gas rigs up 33, and miscellaneous rigs down 1 to 0.

2017, July, 17, 14:10:00

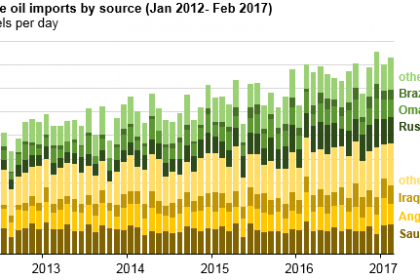

CHINA'S ENERGY DEMAND UP

CHINA will accelerate expanding oil and gas distribution in the next decade to ensure energy security and help boost industry, its top economic and energy planners said.

2017, July, 17, 14:05:00

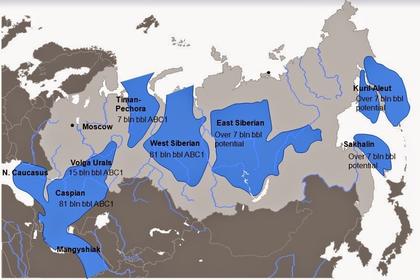

U.S. & RUSSIA: LIMITED IMPACT

The U.S. shale boom—which reshaped world markets for crude oil and natural gas before Mr. Trump took office—has only limited impact on Russia’s standing as a major energy provider to Europe and Asia.

2017, July, 12, 14:15:00

RUSSIA'S INVESTMENT POTENTIAL

"Russia is among the leading energy countries today. We see colossal unrealized potential for cooperation, for investment -- we will continue working on implementing it with all the interested parties," Novak said.

2017, July, 5, 12:20:00

AGAINST RUSSIA SANCTIONS

Exxon Mobil Corp. and other energy companies have joined President Donald Trump in expressing concerns over a bill to toughen sanctions on Russia, arguing that it could shut down oil and gas projects around the world that involve Russian partners.

2017, July, 5, 12:10:00

GE & BAKER HUGHES DEAL

General Electric Co. closed its deal to combine its long-suffering energy business with Baker Hughes Inc. on Monday, creating one of the largest companies in the oil-field services industry.

2017, July, 3, 13:45:00

ROSNEFT - KURDISH TALKS

Russia’s state-controlled oil company is in discussions with Iraqi Kurdistan over helping it develop oilfields in disputed territory at the heart of tensions with Baghdad, in a move that pitches Moscow into one of Iraq’s oldest faultlines.

2017, June, 30, 08:54:00

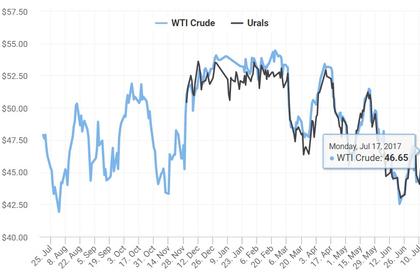

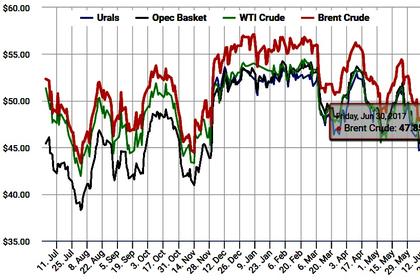

WEEKLY OIL GAS PRICES UP

The August light, sweet crude contract on NYMEX gained 50¢ on June 28 to settle at $44.74/bbl. The September contract was up 50¢ to close at $44.99/bbl.

The NYMEX natural gas price for July gained 3¢ to a rounded $3.07/MMbtu. The Henry Hub cash gas price also gained 3¢ to $3.01/MMbtu.

The Brent crude contract for August on London’s ICE increased 66¢ to $47.31/bbl while the September contract climbed 62¢ to $47.54/bbl. The July gas oil contract gained $4.25 to $427.50/tonne.

The Organization of Petroleum Exporting Countries’ basket of crudes on June 28 was $44.48/bbl, up 25¢.

2017, June, 30, 08:40:00

ROSNEFT & BEIJING GAS DEAL

Rosneft and Beijing Gas Group Company Limited ("Beijing Gas") closed the deal for sale and purchase of 20% shares in Verkhnechonskneftegaz (a Rosneft subsidiary). The price of purchased 20% stake amounted to around USD 1.1bln.

2017, June, 28, 15:20:00

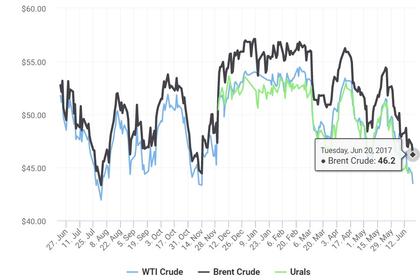

MODEST OIL GAS PRICES

The August light, sweet crude contract on NYMEX gained 37¢ on June 26 to settle at $43.38/bbl. The September contract was up 34¢ to close at $43.61/bbl.

The NYMEX natural gas price for July gained nearly 10¢ to a rounded $3.03/MMbtu. The Henry Hub cash gas price was $2.98/MMbtu, up 12¢.

The Brent crude contract for August on London’s ICE increased 29¢ to $45.83/bbl while the September contract was up 29¢ to $46.04/bbl. The July gas oil contract dropped $1.75 to $409.50/tonne.

OPEC’s basket of crudes on June 26 was $43.14/bbl, down 12¢.

2017, June, 21, 11:25:00

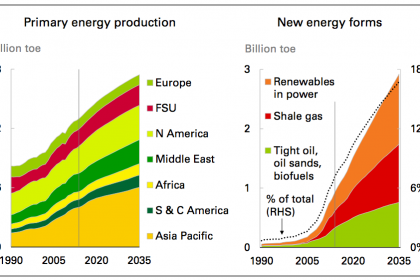

BP ENERGY REVIEW

Bob Dudley, BP group chief executive, said: “Global energy markets are in transition. The longer-term trends we can see in this data are changing the patterns of demand and the mix of supply as the world works to meet the challenge of supplying the energy it needs while also reducing carbon emissions. At the same time markets are responding to shorter-run run factors, most notably the oversupply that has weighed on oil prices for the past three years."

2017, June, 20, 14:10:00

HUGE NORWEGIAN OIL & GAS

“We have been producing oil and gas in Norway for nearly 50 years and we are still not halfway done. Vast volumes of oil and gas have been discovered on the Norwegian shelf that are still waiting to be produced. We want companies with the ability and willingness to utilise new knowledge and advanced technology. This will yield profitable production for many decades in the future,” says Ingrid Sølvberg, Director of development and operations in the Norwegian Petroleum Directorate.