Prices

2017, December, 6, 12:05:00

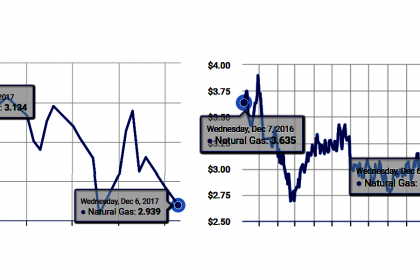

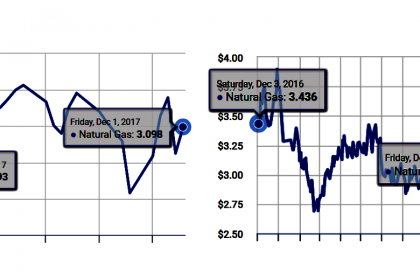

GAS PRICES DOWN TO $2.933

PLATTS - Colder weather outlooks for major heating regions support the upside, while the recent and impending lackluster pace of storage erosion is keeping downward pressure on the market. At 6:50 am ET (1150 GMT) the contract was 5.2 cents lower at $2.933/MMBtu.

2017, December, 4, 23:20:00

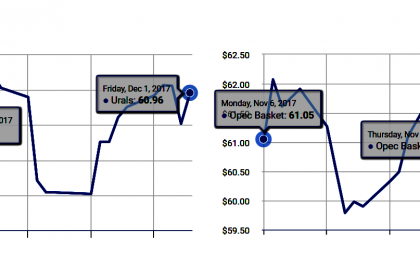

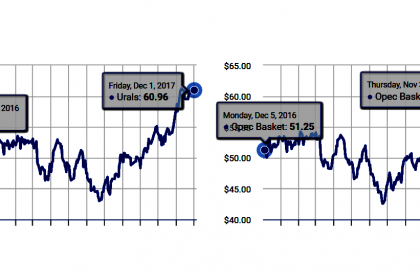

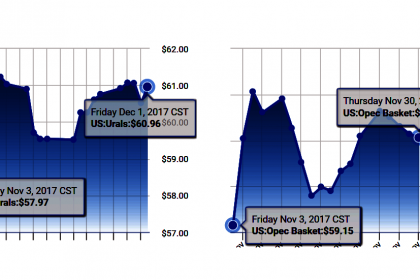

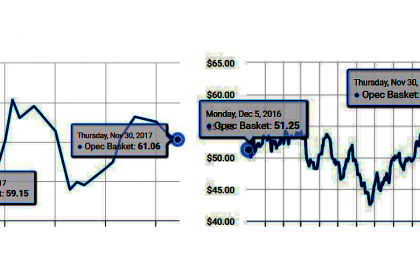

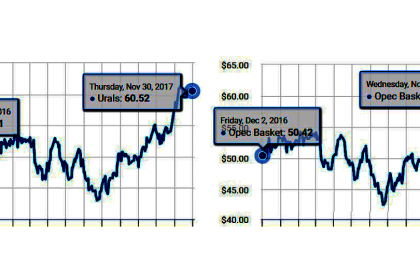

OIL PRICE: NOT ABOVE $64 YET

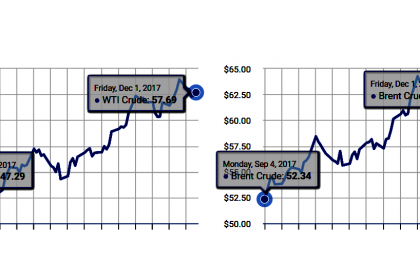

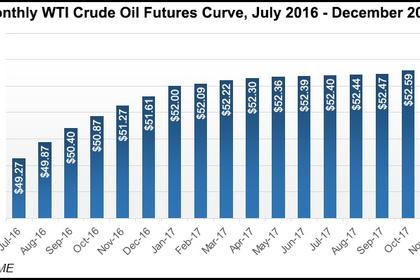

BLOOMBERG - West Texas Intermediate for January delivery was at $57.93 a barrel on the New York Mercantile Exchange at 2:02 p.m. in Seoul, down 43 cents. The contract gained 96 cents to settle at $58.36 on Friday. Total volume traded was about 21 percent below the 100-day average.

Brent for February settlement dropped 36 cents to $63.37 a barrel on the London-based ICE Futures Europe exchange. Prices added $1.10, or 1.8 percent, to close at $63.73 on Friday. The global benchmark crude was at a premium of $5.43 to February WTI.

2017, December, 4, 23:15:00

СОТРУДНИЧЕСТВО С ОПЕК

МИНЭНЕРГО РОССИИ - ОПЕК оставляет в силе решения, принятые 30 ноября 2017 года; в «Декларацию о сотрудничестве» вносится поправка, согласно которой ее срок действия охватывает весь 2018 год с января по декабрь 2018 года, при этом входящие и участвующие в кооперации не входящие в ОПЕК страны обязуются обеспечить полное и своевременное исполнение условий «Декларации о сотрудничестве» и скорректировать объемы добычи в соответствии с достигнутыми на добровольной основе договоренностями.

2017, December, 4, 23:10:00

SAUDI ARABIA - RUSSIA COMPROMISE

REUTERS - The outcome represents a successful compromise between de facto OPEC leader Saudi Arabia (which wanted to announce an extension throughout 2018) and non-OPEC heavyweight Russia (which wanted to avoid giving such a long commitment).

2017, December, 2, 18:54:00

OPEC CONFIRMED

OPEC - In agreeing to this decision, Member Countries confirmed their continued focus on a stable and balanced oil market, in the interests of both producers and consumers. Member Countries remain committed to being dependable and reliable suppliers of crude and products to global markets.

2017, December, 1, 13:05:00

OIL PRICE: NOT ABOVE $64

BLOOMBERG - West Texas Intermediate for January delivery was at $57.72 a barrel on the New York Mercantile Exchange, up 32 cents, at 7:50 a.m. in London. Total volume traded was about 16 percent below the 100-day average. Prices rose 10 cents to $57.40 on Thursday, capping a 5.6 percent gain for November.

Brent for February settlement climbed 43 cents to $63.06 a barrel on the London-based ICE Futures Europe exchange. The January contract expired Thursday after adding 46 cents, or 0.7 percent, to $63.57. The global benchmark crude was at a premium of $5.32 to February WTI.

2017, December, 1, 13:00:00

СОГЛАШЕНИЕ: МЕНЬШЕ НЕФТИ

МИНЭНЕРГО РОССИИ - «Мы успешно и конструктивно провели переговоры по продлению сделки. Мы удовлетворены результатами балансировки рынка, сокращением излишков нефти и нефтепродуктов, снижением волатильности цен, а также возврату инвестиционной активности в отрасли. В тоже время мы также единодушно подтвердили то, что мы находимся лишь в середине пути, и для того, чтобы достичь окончательной цели по балансировке рынка, нам нужно продолжить совместные усилия».

2017, December, 1, 12:55:00

SAUDIS & RUSSIA LEADERSHIP

PLATTS - Saudi Arabia reasserted its leadership of the oil market Thursday after brokering its desired extension of output cuts with OPEC and non-OPEC partners through to the end of 2018.

The deal -- agreed after nearly nine hours of negotiations in Vienna -- kept its new ally Russia onside and prevented a sell-off that many analysts had feared.

2017, December, 1, 12:50:00

OPEC & RUSSIA CUTS

BLOOMBERG - OPEC and its allies outside the group agreed to maintain oil production cuts until the end of 2018, extending their campaign to wrest back control of the global market from America’s shale industry.

2017, December, 1, 12:40:00

GAS PRICES DOWN TO $3.097/MMBTU

PLATTS - Having gained over 5 cents yesterday as the new front month contract, NYMEX January 2018 natural gas futures were lower ahead of Thursday's open and the morning release of the weekly storage data. At 6:45 am ET (1145 GMT), the contract was down 8.2 cents to $3.097/MMBtu.

2017, December, 1, 12:35:00

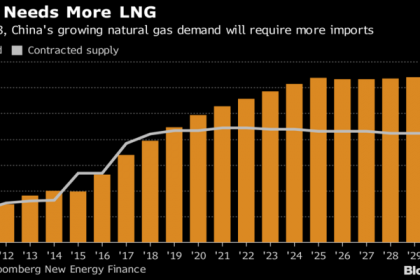

CHINA'S LNG GROWTH

PLATTS - Average domestic trucked LNG prices in China jumped more than 47% since November 14, according to Shanghai Petroleum and Natural Gas Exchange which monitors trucked LNG transactions from 50 LNG terminals and factories.

2017, November, 29, 10:05:00

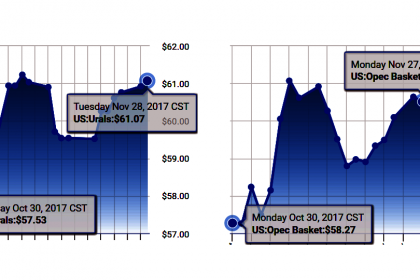

OIL PRICE: ABOVE $63 STILL

REUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $57.67 a barrel at 0427 GMT, down 32 cents, or 0.6 percent below their last settlement.

Brent crude futures, the international benchmark for oil prices, were at $63.14 a barrel, down 47 cents, or 0.7 percent.

2017, November, 29, 10:00:00

OPEC OIL EXPECTATIONS

BLOOMBERG - Implied volatility, a gauge of expected price moves, dropped to about 22 percent on Friday for New York-traded crude. That was the lowest level since early March and close to a three-year low. Other gauges of turbulence have also traded at multi-year lows since the start of October, despite the escalating tensions and meetings this week in Vienna, where OPEC and allied oil-producer states will discuss the extension of supply curbs that propped up the market.

2017, November, 29, 09:55:00

CHINA'S LNG UP

PLATTS - Asia LNG spot prices surged to a near three-year high Monday as surging Chinese demand and robust oil prices coincided with persistent supply anxieties.

2017, November, 29, 09:50:00

SHELL UPDATES STRATEGY

SHELL - “Our next steps as we re-shape Shell into a world-class investment aim to ensure that our company can continue to thrive, not just in the short and medium term but for many decades to come,” said van Beurden. “These steps build on the foundations of Shell’s strong operational and financial performance, and my confidence in our strategy and our ability to deliver on the promises we make.”