Trends

2015, April, 2, 19:40:00

OPEC EARNING: $446 BLN

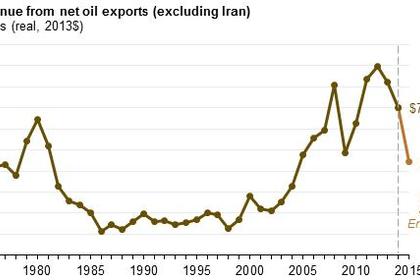

Based on crude oil market assessments in the Short-Term Energy Outlook, EIA estimates that members of the Organization of the Petroleum Exporting Countries (OPEC), excluding Iran, will earn about $700 billion in revenue from net oil exports in 2014, a 14% decrease from 2013 earnings and the lowest earnings for the group since 2010.

2015, April, 2, 19:35:00

THE TALL ORDER: $80/BBL

With Saudi Arabia reluctant to cut production, crude oil prices over the next decade depend greatly on producers’ costs, says a veteran observer of oil markets and the Middle East.

2015, March, 31, 21:10:00

THE TARGET: $100/BBL TO 2018

The prospect of a return to $100-a-barrel crude is tempting some to bet against the bearish consensus in the oil market.

2015, March, 31, 21:05:00

U.S. OIL & GAS M&A

Despite a 50 percent slide in crude prices since last summer, U.S. shale oil producers are enjoying remarkably easy access to capital markets and this will allow them to avoid getting squeezed when banks reset their loans in April.

2015, March, 31, 21:00:00

WORST TO COME

In a keynote speech to attendees of the 2015 Coiled Tubing & Well Intervention Conference & Exhibition, Richard B. Spears, an oil field services market researcher, says the worst may be yet to come for that market, but a partial recovery also could come sooner than expected.

2015, March, 31, 20:55:00

CANADA OIL&GAS M&A

ConocoPhillips is among energy companies considering asset sales amid depressed oil prices, as it markets gas-producing properties that account for about 20% of its production in Western Canada. Whiting Petroleum has hired a bank to explore a sale of the company, people familiar with the matter said last week. The company is selling oil and gas processing assets in North Dakota, Bloomberg News reported in February.

2015, March, 31, 20:50:00

U.S. OIL GROWTH

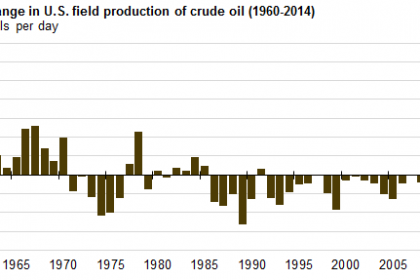

U.S. crude oil production (including lease condensate) increased during 2014 by 1.2 million barrels per day (bbl/d) to 8.7 million bbl/d, the largest volume increase since recordkeeping began in 1900. On a percentage basis, output in 2014 increased by 16.2%, the highest growth rate since 1940. Most of the increase during 2014 came from tight oil plays in North Dakota, Texas, and New Mexico where hydraulic fracturing and horizontal drilling were used to produce oil from shale formations.

2015, March, 31, 20:45:00

U.S. NEED ARCTIC

The U.S. should immediately begin a push to exploit its enormous trove of oil in the Arctic waters off of Alaska, or risk a renewed reliance on imported oil in the future, an Energy Department advisory council says in a study submitted Friday.

2015, March, 31, 20:40:00

UPSTREAM INVESTMENTS: DOWN 12%

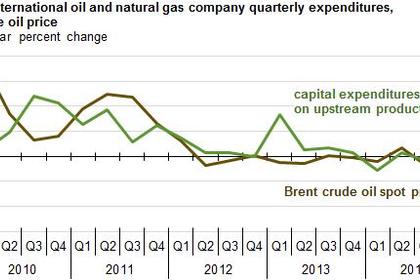

Based on financial statements from selected international oil and natural gas companies, spending on upstream investments was 12% lower in fourth-quarter 2014 compared to the same period in 2013. Upstream spending on exploration and development typically accounts for the bulk of these companies' investment expenditures.

2015, March, 31, 20:25:00

OIL MARKETS: TRAITORS

Oil markets remained volatile Mar. 24 while analysts anticipated a weekly government inventory report showing another climb in US oil and product supplies. US light, sweet crude prices edged up on Mar. 24 to remain under $48/bbl while Brent prices fell modestly to settle at above $55/bbl.

2015, March, 29, 15:30:00

OIL DOWNTURN IS BETTER

Investment bankers and analysts entrenched in the oil and gas industry say companies have so far staved off the major negative impacts of the current industry downturn better than previous downturns by acting more proactively and aggressively.

2015, March, 29, 15:20:00

EU NEED RUSSIAN GAS

Europe's reliance on imports of natural gas is likely to rise from half to three quarters over the next two decades and Russia will continue to supply around 30 percent of EU needs, BP's chief economist said on Friday.

2015, March, 29, 15:15:00

2015: GLOBAL INVESTMENTS WILL DOWN 15%

Schlumberger CEO Paal Kibsgaard said Monday he expects global exploration and production capital expenditures to drop between 10 to 15 percent in 2015.

2015, March, 25, 20:10:00

UNDEFINITE PIPELINE

TAPI faces an uncertain future with the recent oil price fall, ambiguity regarding transit via Afghanistan and an increase in the estimated project cost.

2015, March, 25, 20:05:00

EU ENERGY MARKET

Before Donald Tusk became president of the European Council, the former Polish prime minister had already begun campaigning for a European energy union.