Analysis

2021, July, 27, 11:10:00

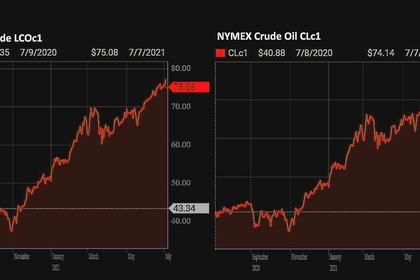

OIL PRICE: NOT ABOVE $75 ANEW

Brent climbed 34 cents, or 0.46%, to $74.84 a barrel , WTI rose 20 cents, or 0.28%, to $72.11 a barrel.

2021, July, 27, 10:45:00

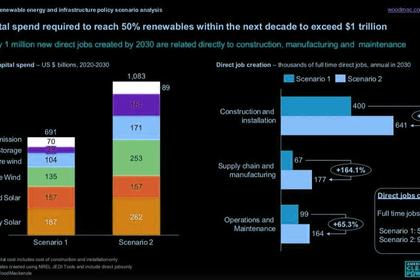

U.S. RENEWABLES 50%

Reaching 50% renewables by the end of this decade would still remain well short of President Biden's call for 80% clean power by 2030 (assuming "clean" means "renewable" and does not include nuclear power or fossil fuels with carbon capture).

2021, July, 27, 10:20:00

U.S. RIGS UP 7 TO 491

U.S. Rig Count is up 7 from last week to 491, Canada Rig Count is down 1 from last week to 149.

2021, July, 9, 12:30:00

OIL PRICE: NOT ABOVE $75

Brent were up 60 cents, or 0.8%, at $74.72 a barrel , WTI were up 69 cents, or 1%, at $73.63.

2021, July, 9, 12:25:00

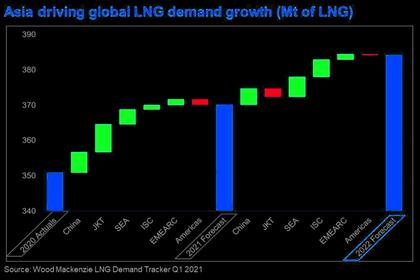

ASIA NEED MORE LNG

The spot and long-term LNG pricing dynamics have shifted dramatically from 2020 to 2021, with record lows to record highs recorded in a period of nine months.

2021, July, 9, 12:20:00

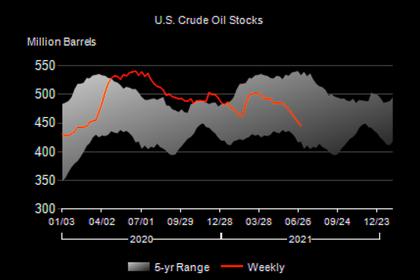

U.S. OIL INVENTORIES DOWN 6.9 MB TO 445.5 MB

U.S. commercial crude oil inventories decreased by 6.9 million barrels from the previous week to 445.5 million barrels.

2021, July, 8, 12:50:00

OIL PRICE: NEAR $73

Brent slipped by 23 cents, or 0.3%, to $73.20 a barrel, WTI were down 33 cents, or 0.5%, at $71.87 a barrel.

2021, July, 8, 12:45:00

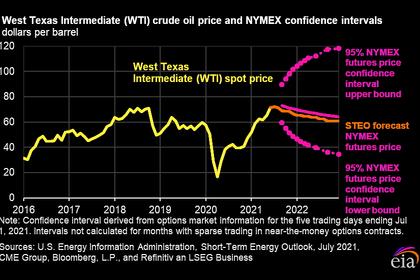

OIL PRICES 2021-22: $72-$67

We expect rising production will reduce the persistent global oil inventory draws that have occurred for much of the past year and keep prices similar to current levels, averaging $72/b during the second half of 2021 (2H21).

2021, July, 8, 12:35:00

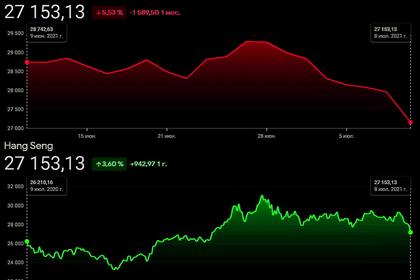

ASIA INDEXES DOWN ANEW

The Hang Seng index (.HSI) led losses with a 1.9% drop, its eighth consecutive session in the red, with more falls in internet giants Tencent (0700.HK), Meituan (3690.HK) and Alibaba (9988.HK) as the sector reels from sweeping Chinese regulatory scrutinty.

2021, July, 8, 12:30:00

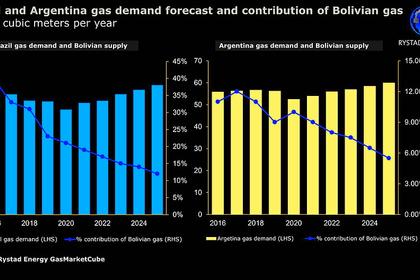

LNG FOR BRAZIL, ARGENTINA

Brazil is responsible for almost half of the imports into South America for the record month, accounting for almost half of the total demand, or 37 Bcf for the month. Imports into Argentina have also been on the rise as domestic gas production and imports from Bolivia have proved insufficient to meet the projected demand for winter in the Southern Hemisphere.

2021, July, 8, 12:25:00

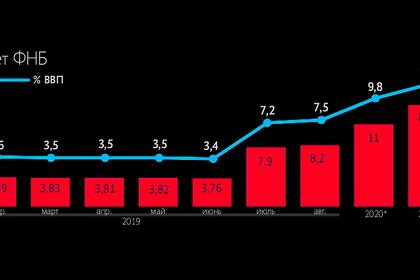

ФНБ РОССИИ $187,6 МЛРД.

По состоянию на 1 июля 2021 г. объем ФНБ составил 13 574 581,2 млн. рублей или 11,7% ВВП, что эквивалентно 187 566,0 млн. долл. США,

2021, July, 8, 12:20:00

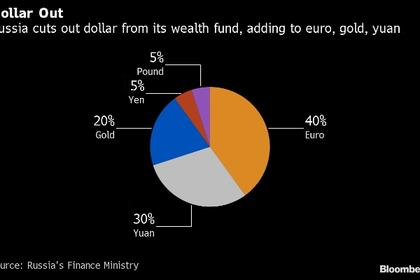

СТРУКТУРА ФНБ РОССИИ

Из структуры средств ФНБ исключен доллар США, доля фунта стерлингов сокращена до 5,0%, доли евро и китайского юаня увеличены до 39,7% и до 30,4% соответственно, доля японской иены составила 4,7%, а доля безналичного золота – 20,2%.

2021, July, 7, 11:30:00

OIL PRICE: NEAR $75

Brent was up 74cents, or 1%, at $75.27 a barrel , WTI was up 88 cents, or 1.2%, at $74.25 a barrel,

2021, July, 7, 11:25:00

OPEC+ NO QUOTAS

The OPEC+ had failed to agree to increase production quotas from August onward after the UAE objected to Saudi Arabia's plan to tie the production increases to a lengthening of the supply management pact through to the end of 2022.

2021, July, 7, 11:20:00

NUCLEAR POWER: NO MORE HARM

This comprehensive 397-page report concluded that there was no science-based evidence that nuclear energy does more harm to human health or to the environment than other electricity production technologies already included in the taxonomy and that the impacts of nuclear energy are mostly comparable with hydropower and the renewables, with regard to non-radiological effects.