Trends

2015, April, 16, 20:05:00

U.S. OIL DECLINED

North Dakota’s oil production declined in February for the second consecutive month as drilling new wells slackened amid low oil prices.

State regulators said Tuesday that February’s output was just short of 1.18 million barrels per day, down 50,435 daily barrels since December, which was the state’s all-time high. It was the first consecutive two-month drop since January 2011.

2015, April, 16, 20:00:00

U.S. WILL BE AN EXPORTER

The United States will transition from a net importer of natural gas to a net exporter of the fuel by 2017 as the nation’s shale gas production continues to grow, the U.S. Energy Information Administration said on Tuesday in its Annual Energy Outlook.

2015, April, 16, 19:55:00

RUSSIAN GAS STRATEGY

On December 1 2014, during his official visit to Turkey, Russian President Vladimir Putin announced the suspension of South Stream, blaming the EU for its “unconstructive” position. In fact, the realization of pipeline had become untenable as a result of various legal, political and financial issues, such as the EU’s Third Energy Package, the Ukraine crisis and the ensuing sanctions over companies involved in South Stream (Stroytransgaz and Gazprombank).

2015, April, 16, 19:50:00

RUSSIAN GAS TO EU

Russia will continue to provide competitive natural gas deliveries to Europe until mid-2020 and there is a limited possibility that other sources including LNG supplies, will offset Russian imports significantly, participants at the Flame conference in Amsterdam said Tuesday.

2015, April, 16, 19:20:00

HARD OIL OUTLOOK

The rebalancing of the global oil market may still be in its early stage with the outlook “only getting murkier”, according to the International Energy Agency, as uncertainties remain about demand and supply responses to the steep drop in prices.

2015, April, 14, 20:20:00

CASH FLOW DOWN

Rapid and aggressive strategic response by oil and gas companies to low oil prices has driven industry cash flow breakevens down by $20/bbl to $72/bbl, according to a recent analysis of Wood Mackenzie. If oil prices remain at current levels, further cuts would be required to achieve cash flow neutrality, WoodMac said. For some companies, this will mean selling assets, others may suspend or limit dividend and buyback programs.

2015, April, 14, 20:15:00

US OIL FALL

Oil production from the fastest-growing U.S. shale plays is set to fall some 45,000 barrels per day to 4.98 million bpd in May from April, the first monthly decline in over four years, projections from the U.S. Energy Information Administration showed on Monday.

2015, April, 14, 20:05:00

OPERATIONS ARE SAFER

Advances in technology, standards and practices in the last five years have made America’s offshore #oil and natural #gas industry safer than ever, #API President and CEO Jack Gerard told reporters on a press conference call today.

2015, April, 14, 20:00:00

OFFSHORE DRILLING UNCERTAINTY

As most drilling companies that have rigs without a contract, today, are idling or cold-stacking these rigs, it is estimated that around 140 rigs are heading toward retirement over the next few years as the industry makes way for the newbuilds scheduled for delivery by the end of the decade. Around 360 rigs that are in the current market fleet are more than 30 years old and must be retired at some point.

2015, April, 9, 19:20:00

RUSSIAN GAS CHALLENGES

The next decade will be critical for the Russian natural gas industry with the outcome largely depending on the nation’s pricing and institutional policies

2015, April, 9, 18:45:00

2016: OIL PRICES COULD BE REDUCED

Iran is believed to hold at least 30 million barrels in storage, and EIA believes Iran has the technical capability to ramp up crude oil production by at least 700,000 bbl/day (bbl/d) by the end of 2016. The pace and magnitude at which those volumes would reach the market would depend on the terms of a final agreement.

2015, April, 9, 18:40:00

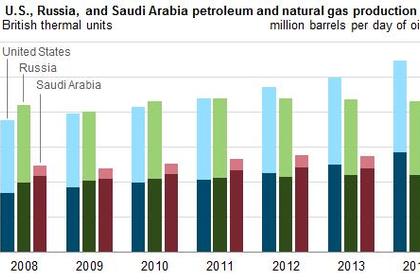

U.S.: THE LARGEST PRODUCER

The United States remained the world's top producer of petroleum and natural gas hydrocarbons in 2014, according to U.S. Energy Information Administration estimates. U.S. hydrocarbon production continues to exceed that of both Russia and Saudi Arabia, the second- and third-largest producers, respectively. For the United States and Russia, total petroleum and natural gas hydrocarbon production, in energy content terms, is almost evenly split between petroleum and natural gas. Saudi Arabia's production, on the other hand, heavily favors petroleum.

2015, April, 9, 18:35:00

U.S.: THE MONEY EXHAUSTED

Ever since the exponential boom of light tight oil (LTO) production flowing from the major shale plays began, American refineries have worked vigorously to process greater LTO volumes. Now a new report has stated that the load is beginning to become a burden, and the cheapest options for refineries to take on the growing amounts of LTO are over.

2015, April, 7, 20:55:00

U.S. SEISMIC SHIFTS

A barrel of crude oil costs under $50, having more than halved in price since June. This means wells are pumping out smaller profits, if not losses. When oil prices plunge and billions of dollars are at stake, oil companies tend to respond quickly to curb production. The number of active rigs has fallen 50 percent since October, according to Baker Hughes, the oilfield services company. This has led to layoffs, tighter budgets and fewer orders for equipment, all which hurt growth.

2015, April, 7, 20:50:00

U.S. CUTTING JOBS

With crude oil prices dropping near $40 a barrel in March, area industry leaders are reacting to the deflated market prices by cutting jobs and ramping down production.