Finance

2019, November, 11, 12:50:00

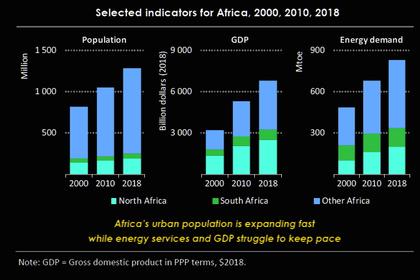

AFRICA'S ENERGY DEMAND GROWTH TWICE

Energy demand in Africa grows twice as fast as the global average, and Africa’s vast renewables resources and falling technology costs drive double-digit growth in deployment of utility-scale and distributed solar photovoltaics (PV), and other renewables, across the continent.

2019, November, 11, 12:45:00

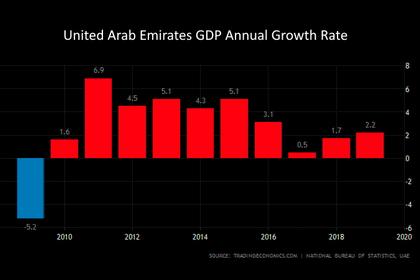

UAE GDP GROWTH 2.5%

Following a challenging period, the economy is recovering. Non-oil growth could exceed 1 percent in 2019 and pick up to around 3 percent next year, the fastest since 2016, on the back of Expo 2020 and fiscal stimulus. Overall GDP growth would register 2.5 percent in 2020.

2019, November, 8, 11:25:00

GAZPROM, UKRAINE STRATEGIC ISSUES

Alexey Miller pointed out that a number of strategic issues need to be resolved prior to the signing of a new transit contract.

2019, November, 8, 11:20:00

POLAND'S FINE FOR NORD STREAM 2

Poland sees Nord Stream 2, which would double Russia’s gas export capacity via the Baltic Sea, as a threat to Europe’s energy security and argues it will strengthen Gazprom’s already dominant position on the market.

2019, November, 8, 10:35:00

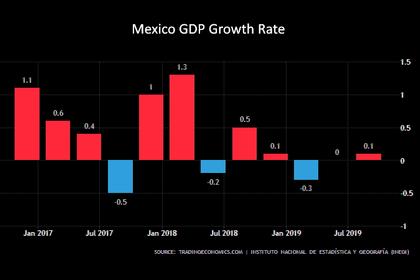

MEXICO'S ECONOMY GROWTH 1.3%

Mexico's economy growth is expected to accelerate modestly in the near-term, reaching 0.4 percent in 2019, as macroeconomic policies become less contractionary. It is projected to recover to 1.3 percent in 2020 on the back of strengthening consumption and despite continued weakness in investment.

2019, November, 7, 13:41:48

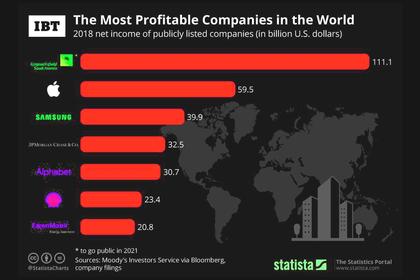

SAUDI ARAMCO IPO

Saudi Aramco’s vision is to be the world’s pre-eminent integrated energy and chemicals company.

2019, November, 6, 12:50:00

UKRAINE NEED RUSSIA'S $12 BLN

Gazprom has offered to Naftogaz the chance to start over with a clean slate provided all legal disputes were dropped.

"There are known cases in international practice when disputes between companies were settled out of court, and we are offering a zero option whereby all court proceedings would cease, all lawsuits would be withdrawn, and we would draw a line under this whole affair," Miller said last month.

2019, November, 6, 12:35:00

U.S. INTERNATIONAL TRADE DEFICIT $52.5 BLN

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced that the goods and services deficit was $52.5 billion in September, down $2.6 billion from $55.0 billion in August,

2019, November, 6, 12:30:00

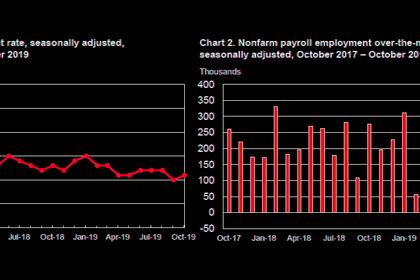

U.S. UNEMPLOYMENT 3.6%

Total nonfarm payroll employment rose by 128,000 in October, and the unemployment rate was little changed at 3.6 percent, the U.S. Bureau of Labor Statistics reported

2019, November, 6, 12:25:00

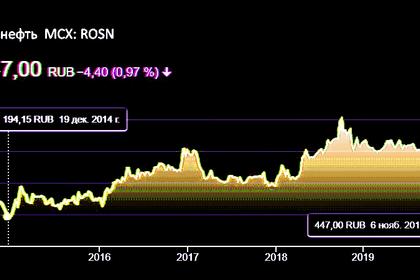

ROSNEFT'S NET INCOME +25%

9M 2019 Net income jumped by 25% YoY to RUB 550 bln, including a QoQ growth to RUB 225 bln in 3Q 2019

2019, November, 5, 14:30:00

4 UNDERVALUED ENERGY STOCKS. NOVEMBER 2019

Let’s see which companies are still undervalued and which ones are out of my radar. Some of them reached their fair value and some other stopped to satisfy my parameters.

2019, November, 5, 14:25:00

SAUDI ARAMCO'S PROFIT $68.2 BLN

Saudi Aramco earned net income of $68.2 billion compared with $83.1 billion for the same period a year ago, it said in a statement posted on its website. The state company’s revenue slipped to $217 billion from $233 billion.

2019, November, 5, 14:20:00

SAUDI ARAMCO'S VALUE $1.5 TLN

Bankers have told the Saudi government that investors will likely value the company at around $1.5 trillion, somewhat below the $2 trillion valuation by Saudi Crown Prince Mohammad Bin Salman when he first floated the idea of an IPO nearly four years ago.

2019, November, 5, 14:15:00

EXXONMOBIL EARNINGS $3.2 BLN

Exxon Mobil Corporation announced estimated third quarter 2019 earnings of $3.2 billion, or $0.75 per share assuming dilution. Earnings included a favorable tax-related identified item of about $300 million, or $0.07 per share assuming dilution. Capital and exploration expenditures were $7.7 billion, including key investments in the Permian Basin.

2019, November, 5, 14:10:00

CHEVRON NET INCOME $2.6 BLN

Chevron Corporation (NYSE: CVX) reported earnings of $2.6 billion ($1.36 per share - diluted) for third quarter 2019, compared with $4.0 billion ($2.11 per share - diluted) in the third quarter 2018. Included in the current quarter was a tax charge of $430 million related to a cash repatriation. Foreign currency effects increased earnings in the third quarter 2019 by $74 million.